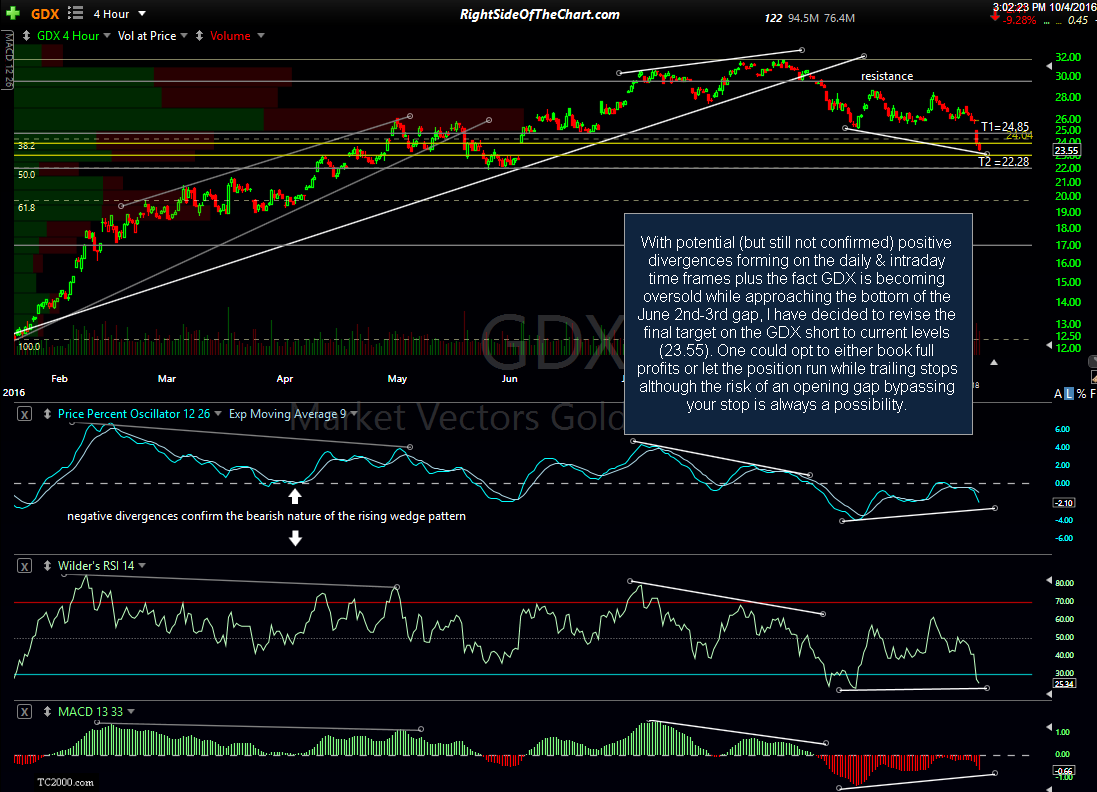

With potential (but still not confirmed) positive divergences forming on the daily & intraday time frames plus the fact GDX is becoming oversold while approaching the bottom of the June 2nd-3rd gap, I have decided to revise the final target on the GDX short to current levels (23.55). This provides the GDX short trade with profit of 16.4% from the August 24th short entry at 28.16. One could opt to either book full profits or let the position run while trailing stops although the risk of an opening gap bypassing your stop is always a possibility.

Covering GDX Short, Final Target Revised

Share this! (member restricted content requires registration)

9 Comments