A friend/trader colleague of mine, Michael Kalin, forwarded this to me tonight. It’s a comparison that he made of the final thrust of the initial counter-trend rally (B) that came after the first leg down in the bear market that began back in Oct ’07 to the price action since the Sept 14, 2012 recent market top. The Oct ’07 bull market top was what I referred to earlier today as an “A” top followed by the “B” lower high peak on Dec 11, 2007. Not only does Mike highlight an almost uncanny similarity in the price action between now & then but he also does a great job of pointing out the similarities as far as trader sentiment and the effect….or more importantly the presumption of the effect that the majority of market participants believed that the actions of the Fed would exert on the market going forward. Without further ado, here is “He knows when you’ve been shorting…” by Michael Kalin:

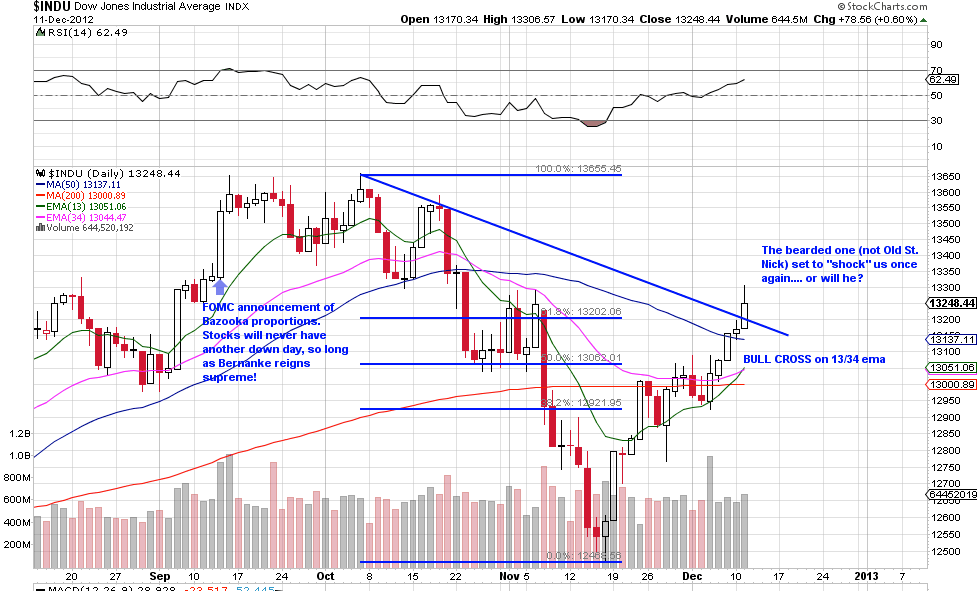

Yes, Ben Bernanke’s coming to town. Here’s a re-visit of a similarity I brought up back in October when the Great Bearded One provided Shock and Awe that has only had one similarity (from what I saw). Oct 2007. Same deal. Market was rallying like a Pavlovian Dog…. searching for the treat. And it got it, and then some. While “Don’t Fight the Fed” and “BTFD” were the mantras following that meeting, newly minted bulls got their butts promptly handed to them. Fast forward to October 2012. The Dogs buy right up to the Bernanke’s meeting, then SURPRISE! Giant treat! Don’t want to miss out on the next treat do we?

December 10, 2007 had lots going for it. After a disappointing month following the October Fed meeting, stocks were rallying for that treat again. And after one Bearded man would deliver a treat, surely the Santa rally would finish the year off at fresh new highs! Then, meeting happens, rate is cut 0.25% — stocks SELL! And HARD!!!

It is tough to ignore the technicals that are accompanying the sentiment. Back in 2007, the Fed was our Savior (not necessarily economic growth). Are we any different today? Are we more acutely aware of our Pavlovian conditioning to not have the EXACT same thing happen? Who knows. I have my reasons for being selectively short and having NO longs (that have nothing to do with Bernanke, seasonality etc.).