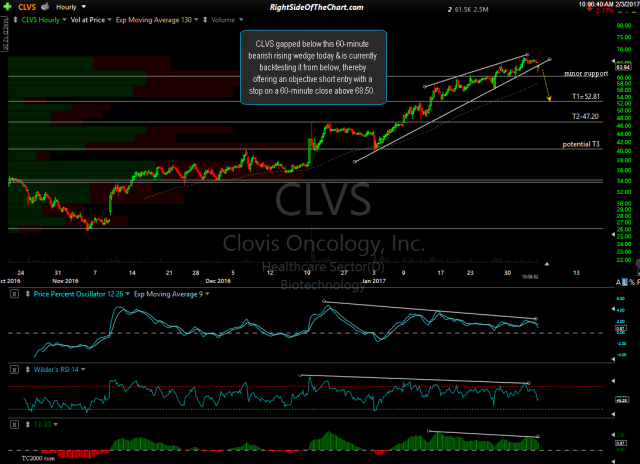

The CLVS (Clovis Oncology) Active Short Trade broke down below the 60.47 minor support level today, bringing the trade to an 8.3% gain before reversing & currently back-testing the former support, now resistance level from below. Previous & updated 60-minute charts:

- CLVS 60-min Feb 3rd

- CLVS 60-min Feb 7th

Today’s reversal in CLVS, with the stock profitable by 8.3% at the lows, occurred on a tag of the 130-period EMA which often acts as support or resistance when tested from above or below. As with most support levels, a reaction off the initial tag from above is quite common although my expectation is that any bounce will be relatively fleeting. As of now, the suggested stop for this trade will remain any 60-minute close above 68.50 which allows for the possibility of a back-test of the bearish rising wedge pattern although I don’t expect this bounce to go that far. Ideally, CLVS will fail here on the back-test of the 60.50ish resistance level but if taken out, the next minor resistance comes in around 64.50.