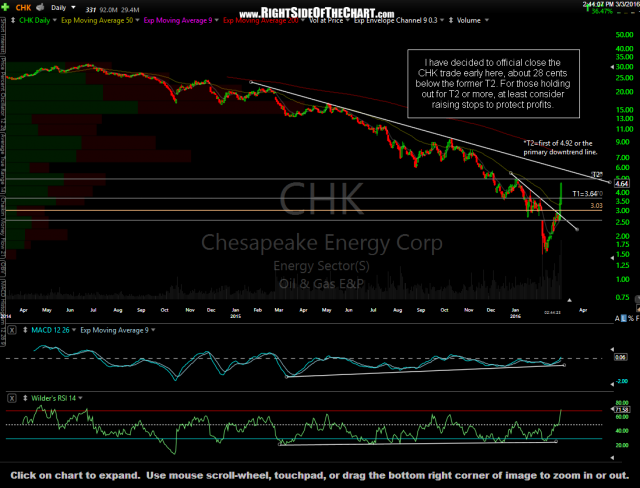

Upon further review of the charts, including the fact that XOP (S&P Oil & Gas E&P ETF) is approaching resistance were a reaction is likely, I have decided to close the CHK (Chesapeak Energy Corp) trade here at 4.64, locking in a 49.2% gain in less that 24 hours. The fact CHK moved up so close to the final target in less than 24 hours allows me to lock in gains & have that capital ready to redeploy on the next trading opportunity, as I’ve discussed in the past using the term velocity (my explanation is pasted at the bottom of this post).

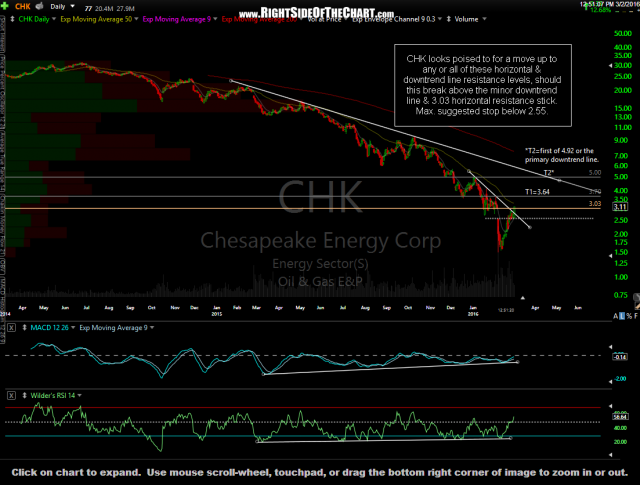

- CHK daily March 2nd

- CHK daily March 3rd

Again, CHK may very well continue higher & even the resistance that I see on XOP ranges from 28.30 up to around 29.25 so with XOP trading at 28.00 right now, there is still a little more room to run in the E&P sector. However, CHK will now be removed from the Active Trades category & moved Completed Trades. (note: A quick heads up on closing out CHK was provided in trading room as it takes quite a bit to time to annotated & upload charts as well as compose a post.)

Velocity Explained: cut & pasted from a previous post back in 2012: Another thing to consider is this: For a trader, profitability is all about velocity. I would rather make 10% in two weeks on a short than 10% on a long that takes 2 months. For example, if an active trader starting with $10,000 were to make just one trade for month for a 10% gain (reinvesting his gains), every month, at the end of one year they would have $31,848.28. If another trader who started with the same $10k, reinvesting the profits into each new trade made the same 10% per trade but had a holding period of 3 months to do so (4 trades per year), they would have $14,641.00 at the end of the first year…. less than 1/2 the amount as the trader with the higher velocity but same percentage gains per trade. This is why I will often state that I think full profits should be taken at a final target even if I believe that the trade might continue to play out for additional gains over time. It’s a matter of being able to re-deploy that capital into another trade offering a much better R/R profile and usually a much shorter expected holding period to make the same percentage gain on the next target.