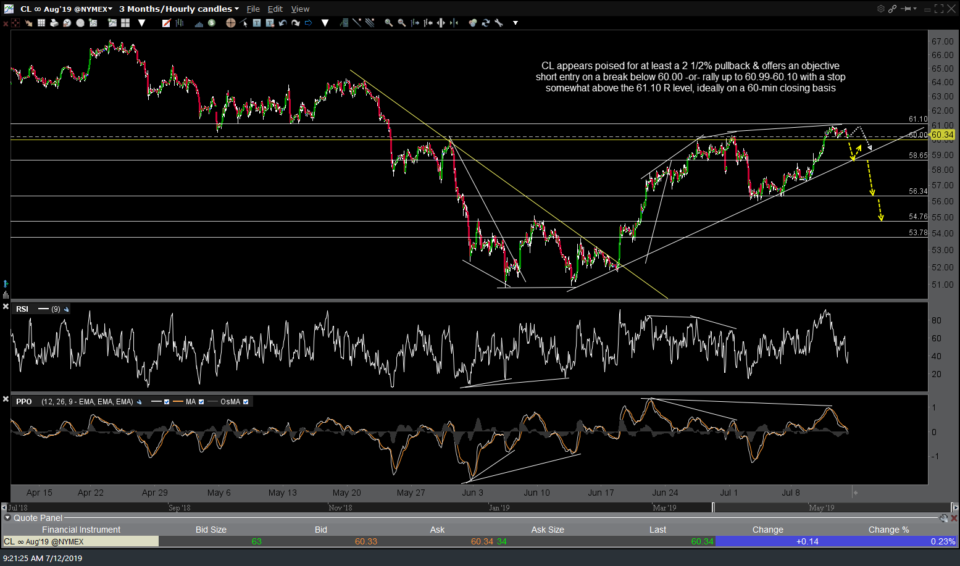

/CL (crude futures) appears poised for at least a 2½% pullback & offers an objective short entry on a break below 60.00 -or- rally up to 60.99-60.10 with a stop somewhat above the 61.10 R level, ideally on a 60-min closing basis, targeting just above the 58.65 price support plus intersecting downtrend & uptrend lines on this 60-minute chart.

While the odds for a reaction off that target level, assuming it is hit soon, are good, there is also a very decent chance that /CL will go on to break below the uptrend line + 58.65 support following any reaction at that level (or possible without a reaction). As such, a short on crude oil could also be tucked away as a swing trade targeting the minor support level around the 56.30-56.35 area & quite likely the 54.75ish support.

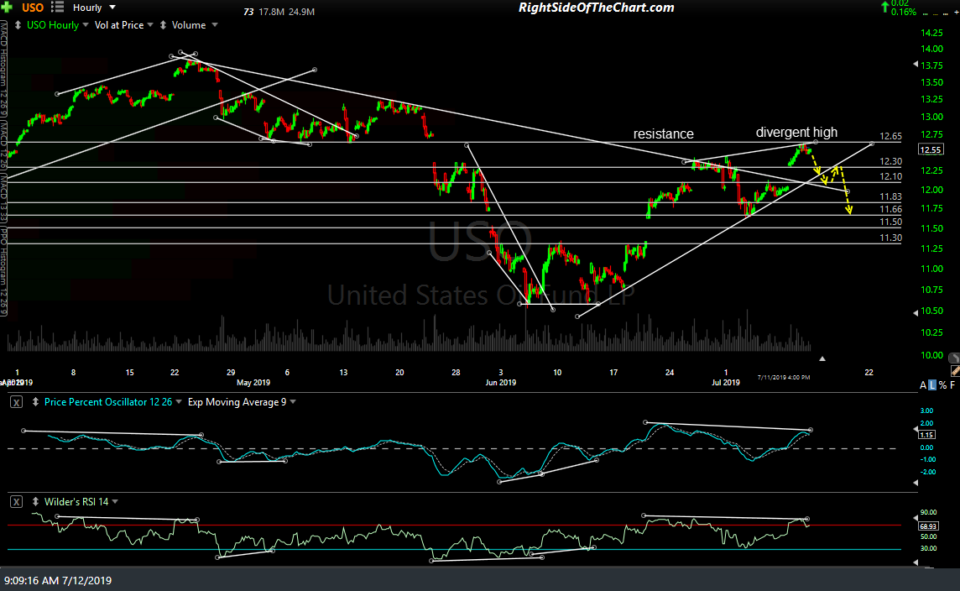

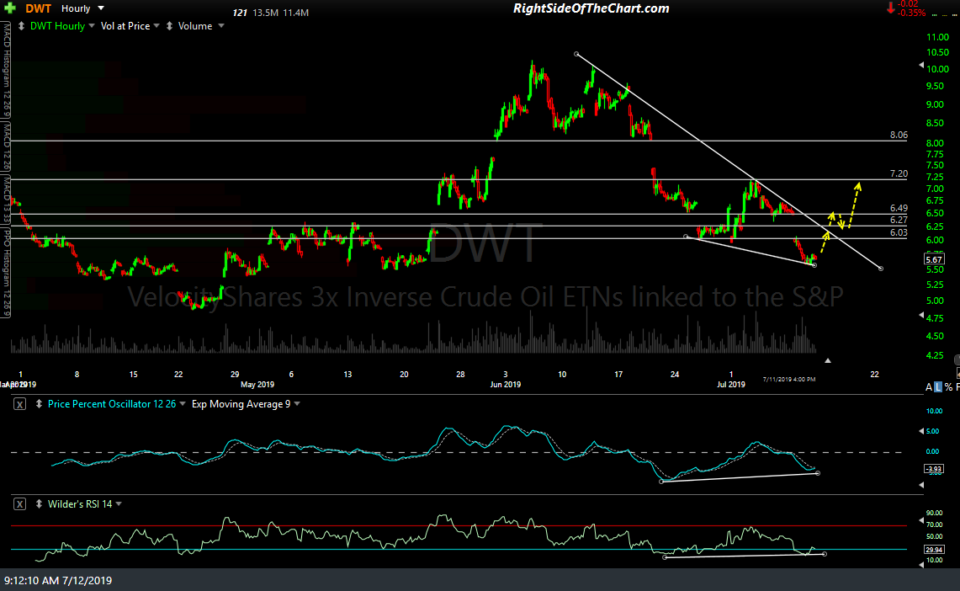

I might add USO (crude ETN) or DWT (3x short crude ETN) as official trade ideas as I don’t use futures as the proxies for the official trades as many retail traders don’t have access to a futures account. Official trades are always individual stocks, ETFs or ETNs although I often share the charts of any related futures contracts for those interested. Official trades also use entry & exit prices based on the regular trading session although both USO & DWT are available to trade in the pre-market & after-hours session.

- USO 60-min July 12th

- DWT 60-min July 12th

60-minute charts of USO & DWT with some key levels are shown above but I find it best to use /CL and/or USO for timing entries & exits vs. DWT as the latter suffers from decay due to the 3x leverage, which can paint a distorted technical picture regarding trendlines & support/resistance levels.