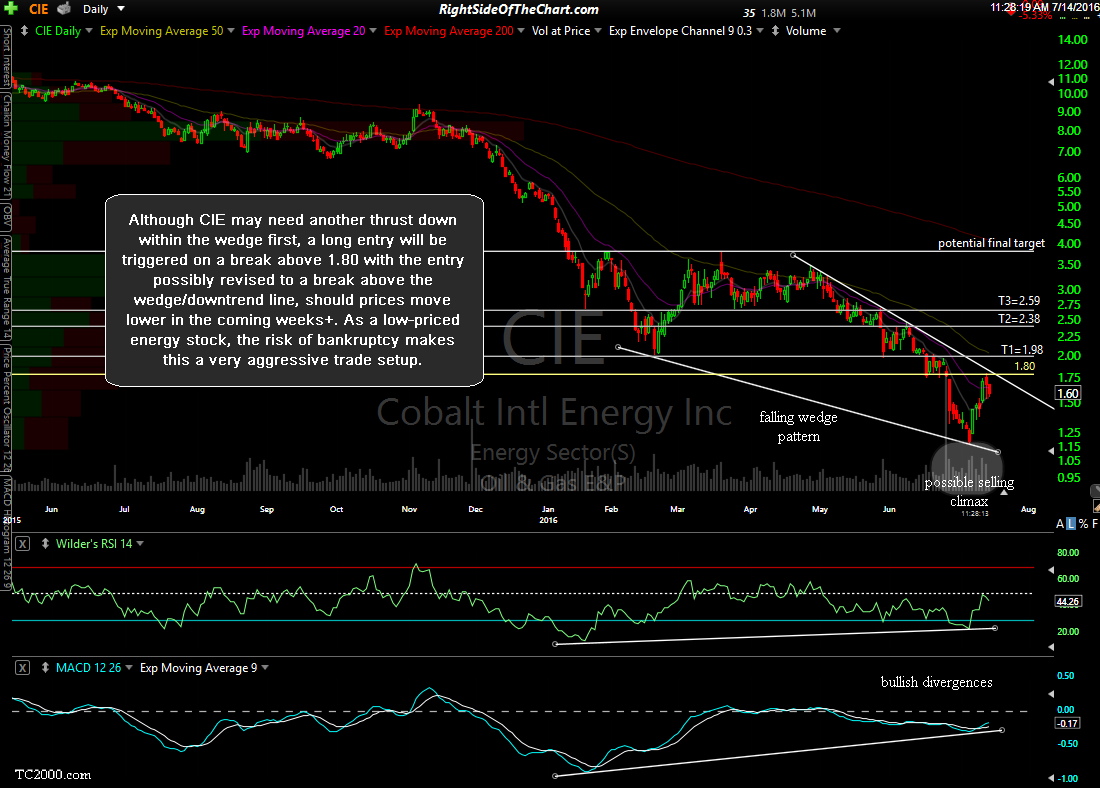

Although CIE (Cobalt Int’l Energy Inc) may need another thrust down within the wedge first, a long entry will be triggered on a break above 1.80 with the entry possibly revised to a break above the wedge/downtrend line, should prices move lower in the coming weeks+. The maximum suggested stop (based on an entry over 1.80 and targeting T3) is any move below 1.60 with those only targeting T1 or T2 might consider a tighter stop using an R/R of 3:1 or better. As a low-priced energy stock, the elevated risk of bankruptcy makes this a very aggressive trade setup.

CIE Trade Setup

Share this! (member restricted content requires registration)

14 Comments