First target hit for a 17% gain in just over 2 hours. Consider booking partial or full profits and/or raising stops, depending on your trading plan. T2 remains the final target at this time although a pullback on the initial tag of the 3.70ish level is likely.

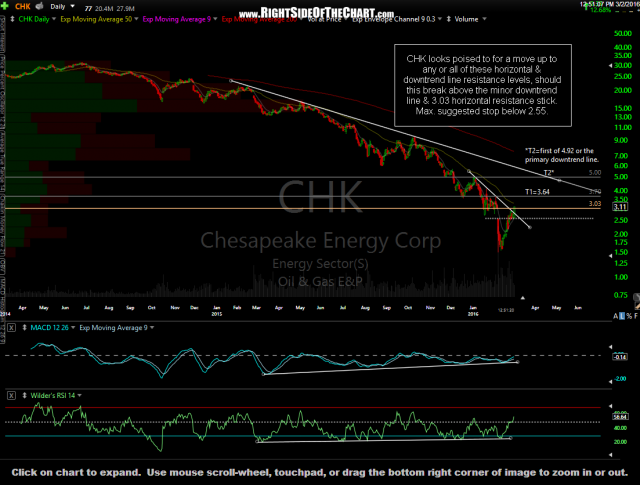

- CHK daily March 2nd

- CHK daily 2 March 2nd

The way I traded/am trading CHK was to take a typically swing position on the original breakout over the minor downtrend line & 3.03 resistance level. Once it (quickly) became apparent that the momo (momentum) traders were jumping on board this one, I waited for a possible entry for a daytrade sized position (typically 3-5x what I’d take home overnight in a swing trade position as I’ll be out before the close, hence, no risk of getting caught on the wrong side of a gap).

- CHK 3 minute March 2nd

- CHK 3 minute 2 March 2nd

- CHK 3 minute 3 March 2nd

Once it was clear that a bear flag continuation pattern was forming on the 3-minute intraday chart (the first chart below, which was posted in the trading room at the time), I waited for an upside break of the pennant in which to establish a daytrade position. As mentioned in the second update on that flag (also posted in the trading room), I wasn’t going to hold out for the measured target of the bullish pennant pattern because I had a key resistance level on the daily chart at 3.70. Daily levels & chart patterns ALWAYS supercede intraday levels & patterns in my book. Hence, I booked full profits on the day trade position at my first target, expecting CHK to hit the 3.70 level before reversing and shorted there for a quick pullback trade (which I’m about to close… correction, just closed at 3.35). Note: The pullback short trade was a reversal of the daytrade. The swingtrade position taken earlier will be taken home & left to hold out for T2 at this time unless stopped out or closed early first.