/NQ & /ES (Nasdaq 100 & S&P 500 futures) continue to work their way higher within the 60-min bearish rising wedge patterns with a sell signal to come on a break below both wedges. Dotted blue lines at top of chart market the previous highs which are likely to come into play as resistance, even if one or both indexes make a brief overshoot, which has been the norm since the early 2018 reaction high as shown on the $SPX daily chart below.

- NQ 60-min June 20th

- ES 60-min June 20th

- $SPX daily June 20th

Despite my expectation that these rising wedge patterns will break down soon with any test of the previous highs or marginal new highs in the indexes likely to be followed by another correction, I do not plan to modify the stops on the QQQ or TVIX official trades. I suspect that the overnight rally in the futures is just part of the typical post-FOMC noise but if they take out the stops on either or both of those trades, I’ll just wait for the next objective entry.

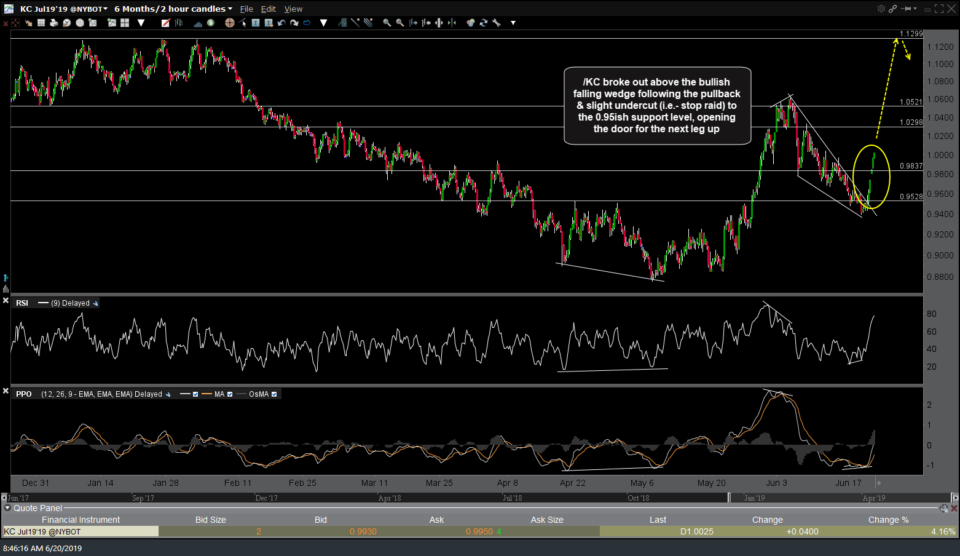

/KC coffee futures broke out above the bullish falling wedge following the pullback & slight undercut (i.e.- stop raid) to the 0.95ish support level, opening the door for the next leg up in coffee. Although the JO coffee ETN trade is poised for a significant gap up due to the overnight move in coffee futures, it still offers an objective entry or add-on around current levels. I would also suggested watching yesterday’s Agricultural Commodities video when you get a chance.

- KC 60-min June 17th

- KC 60-min June 20th

- JO daily June 20th

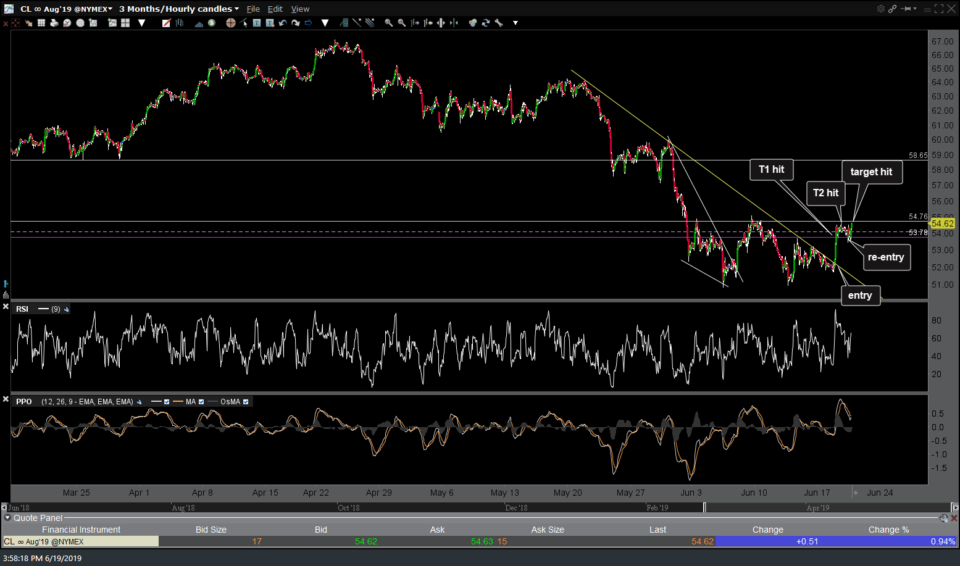

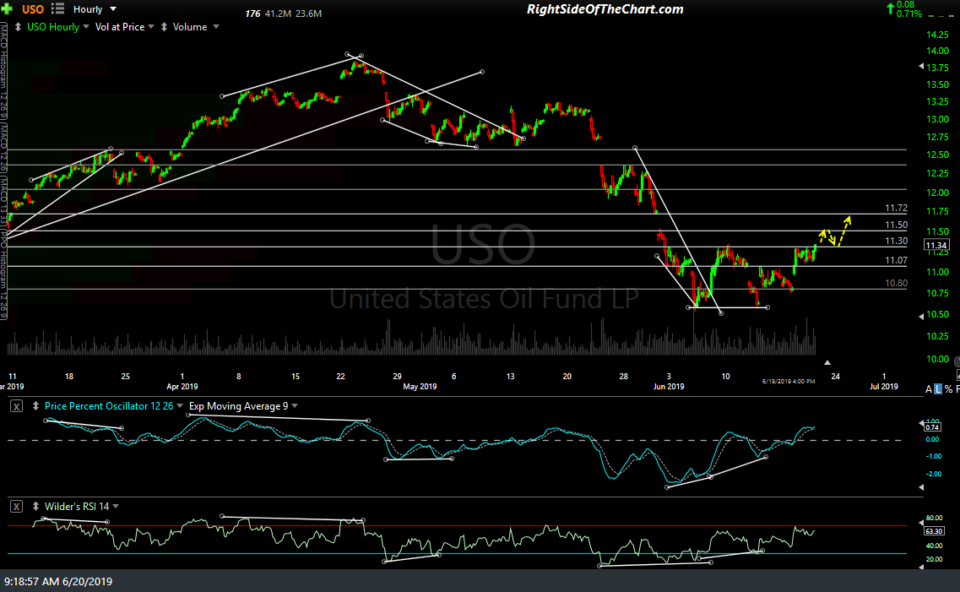

/CL crude oil has provided several profitable trades as it has just done an excellent job of trading off the technicals recently as this string of 60-minute charts posted illustrates. After hitting that second target once again following the 2nd long/re-entry, /CL went on to break out above that level & as of now, may offer another objective long entry should it pull back to test the 54.76ish level from above (with a stop somewhat below).

- CL 60-min June 17th

- CL 60-min June 18th

- CL 60-min June 19th

- CL 60-min 2 June 19th

- CL 60-min June 20th

- USO 60-min June 19th close