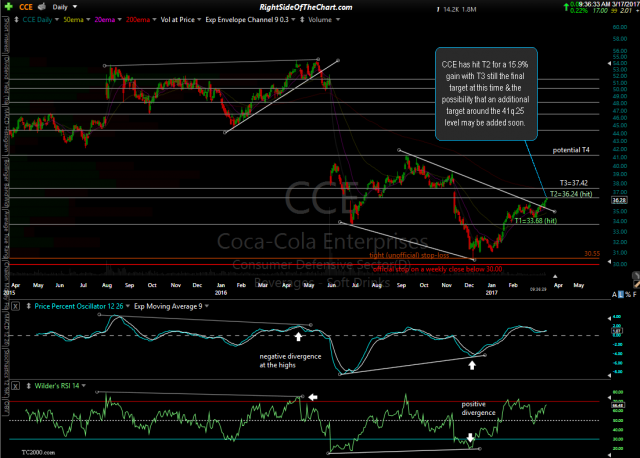

The CCE (Coca-Cola Enterprises ) Active Long Swing Trade & Active Growth & Income Trade has just hit the second price target, T2 at 36.24, for a 15.9% gain*. CCE was added as a Long Swing Trade as well as a Growth & Income Trade just over 3 months ago on December 7th at 31.45. The asterisk denotes that the gain calculated on this trade reflects the adjustment for the dividend of 0.177 which was paid out on Jan 13th to shareholders of record on Dec 30th. CCE should also be paying out another dividend in the coming weeks. Original & updated daily charts shown below.

- CCE daily Dec 7th

- CCE daily March 17th