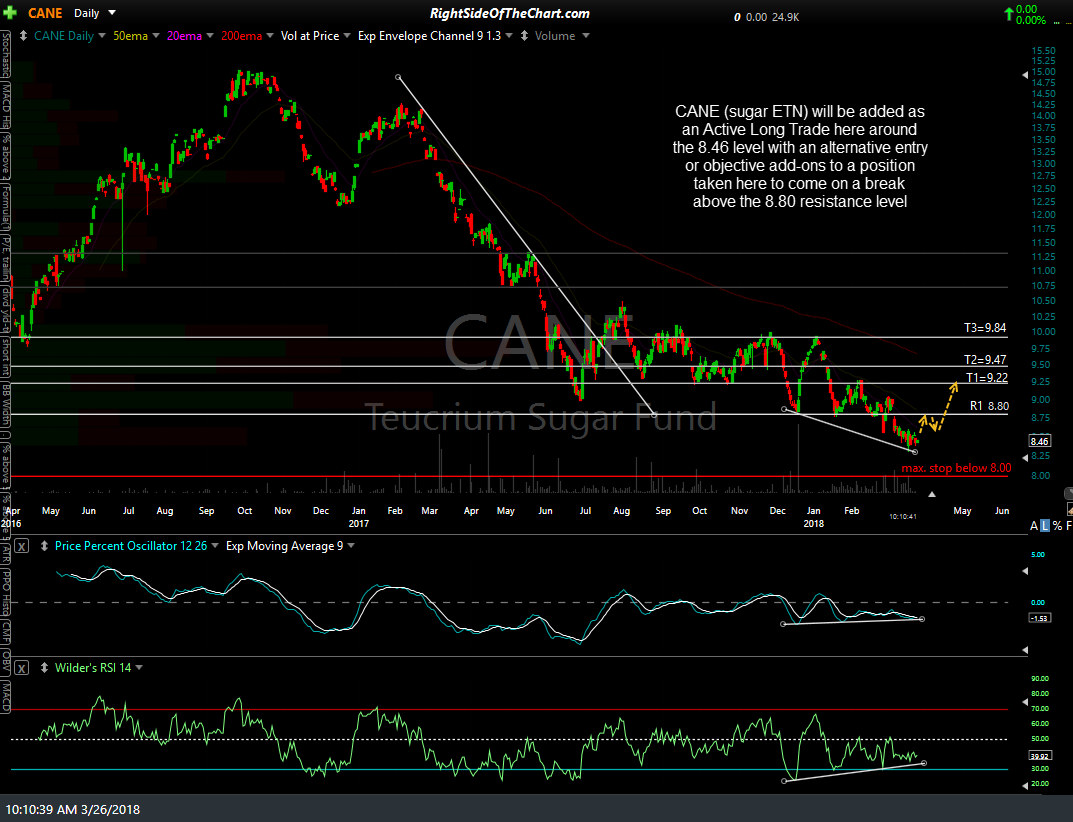

CANE (sugar ETN) will be added as an Active Long Trade here around the 8.46 level with an alternative entry or objective add-on to a position taken around current levels to come on a break above the 8.80 resistance level. The price targets are T1 at 9.22, T2 at 9.47 & T3 at 9.84 with the possibility of additional price targets, depending on how the charts develop going forward.

The maxium suggested stop for this trade is any move below 8.00 with a higher stop suggested if only targeting T1 or T2. The suggested beta-adjusted position size for this trade is 1.0 (a typical position size). CANE is one of three ETNs that track sugar prices with SGG soon to be delisted & replaced with SGGB. As SGG is no longer available for opening transactions (purchases) & SGGB a new ETN without enough price history to effectively use technical analysis, I have opted to use CANE as the official proxy for this trade while those with the experience & access to trade futures might opt to use /SB (sugar #11 futures contract). A description of CANE can be viewed by clicking here.

- sugar futures daily chart 3-26-18

- sugar futures L-T daily chart 3-26-18

The daily charts above show sugar futures trading at a fairly well defined support level with bullish divergences in place on the momentum indicators. Should sugar prices reverse off this support level as the charts indicate is likely, sugar futures appear poised to rally anywhere from 9%-20% in the coming weeks to month. Adding sugar as an Active Trade is inline with my plan to continue to focus on finding the most attractive trading opportunities using various asset classes (e.g.- stocks, bonds, commodities, etc.) for both swing trading & investment porfolios with the goal enhancing returns while reducing overall volatility.