I received a comment on the previous update on GLD & SLV as to the fact that the 120-minute SLV chart did not have positive divergence in place. Although that is the case and although I often look for bullish and bearish divergences as supporting evidence for a likely reversal on a trade candidate, it is not a must. The basis for adding exposure to GLD, SLV & the miners as they’ve fallen to these recent support levels is that my longer-term read on the charts remains bullish and as such, my preference is to add back the exposure that I reduced just over a month ago at the areas that I think a reversal is most likely to occur. Various factors go into my analysis with support & retracements levels given the largest weighting and divergences and other variables also factored in.

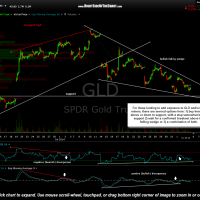

As I attempt to keep my analysis & the charts that I post as streamlined as possible, I didn’t show it previously but you can see on these 60 minute charts that those horizontal support levels in GLD & SLV, which are both defined by the bottom of the Fibonacci retracement levels to both GLD & SLV (from the June 3rd lows in GLD & May 30th low in SLV to the July 10th highs in both) come in either just below (SLV) or exactly on (GLD) those horizontal support levels that I’ve been targeting. In technical analysis, at least in my book, pullbacks to combined support levels of both Fibonacci retracements and price support are about the most objective & high probability areas to position for a reversal, especially when the price & momentum indicators and oscillators, such as the MACD & RSI confirm a likely reversal off those levels, as they current do.

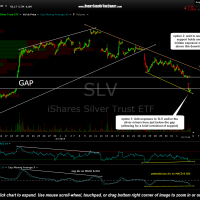

- SLV 30 minute Aug 5th

- SLV 60 minute Aug 5th

- GLD 30 minute Aug 5th

- GLD 60 minute Aug 5th

That actually brings me to my final point: Time Frames. When positioning for a trade based primarily off the daily charts, I will often use the intraday time frames (e.g. 30 or 60 minute chart) to help hone down my entries and exits. In the case of gold, I’ve already made the case, right or wrong, that a new cyclical bull market may be underway. That largely drives my overall bias for trading gold & the miners at this time although as I’ve mentioned, there’s still some work to be done on the longer-term charts in order to say with a fair degree of confidence that the bear market in gold that started in 2011 is behind us.

Regardless, with my intermediate & longer-term bias towards gold being bullish, I have positioned long for both of the major rips this year (as well as the major rip off the mid 2013 lows), booking profits on my swing trade positions only when the charts were clearly indicating that corrections were likely due to the extreme overbought conditions, blatant bearish divergences, and the fact that many of my price targets on the individual miners were all hit within close proximity (all of those conditions were in Aug 2013, late Feb/early March 2014 and again just recently).

Continuing on my point of focusing on the shorter-term time frames in order to hone my entries & exits on trades, I have most recently been posting the 120-minute (2-hour) charts on GLD & SLV, where in that comment mentioned above, the trader inquired about the lack of positive divergence on SLV. Although highlighting the 120-minute charts to help highlight all the support levels, divergences, bullish chart formations, etc.., I have been watching the shorter-term charts, namely the 15, 30, & 60 minute charts, and I’ve noticed potentially bullish developments on all.

The 30 minute charts above show the bullish divergences in place on GLD as well as SLV. Just one more reason that I believe the odds for a reversal on or around these levels is likely. I’ve also added some notations to these charts showing a couple of different entry criteria that can be used for those who are also looking to re-position, scale-in, or add new exposure to the metals or miners. I realize that my trades often involve catching bottom & tops and in doing so, I’m usually buying when most are selling and selling/shorting at times when most are only interesting in buying… hence the name Right Side of the Chart (using what I see to the left, or past price history, in order to predict what will happen at the right side of the chart, i.e.- the future). As this contrary trading style is certainly not for everyone, I will often list alternative, more conservative entries on my trade ideas, such as waiting for a confirmed reversal in GLD & SLV off these support levels and then waiting for those downtrend lines above to be taken out.