/BRR (Bitcoin futures) offers an objective long entry here at support and/or on a break above the first downtrend line with either a relatively tight stop somewhat below 6400 or a scale in position started here adding down to but not below the uptrend line. Daily chart below.

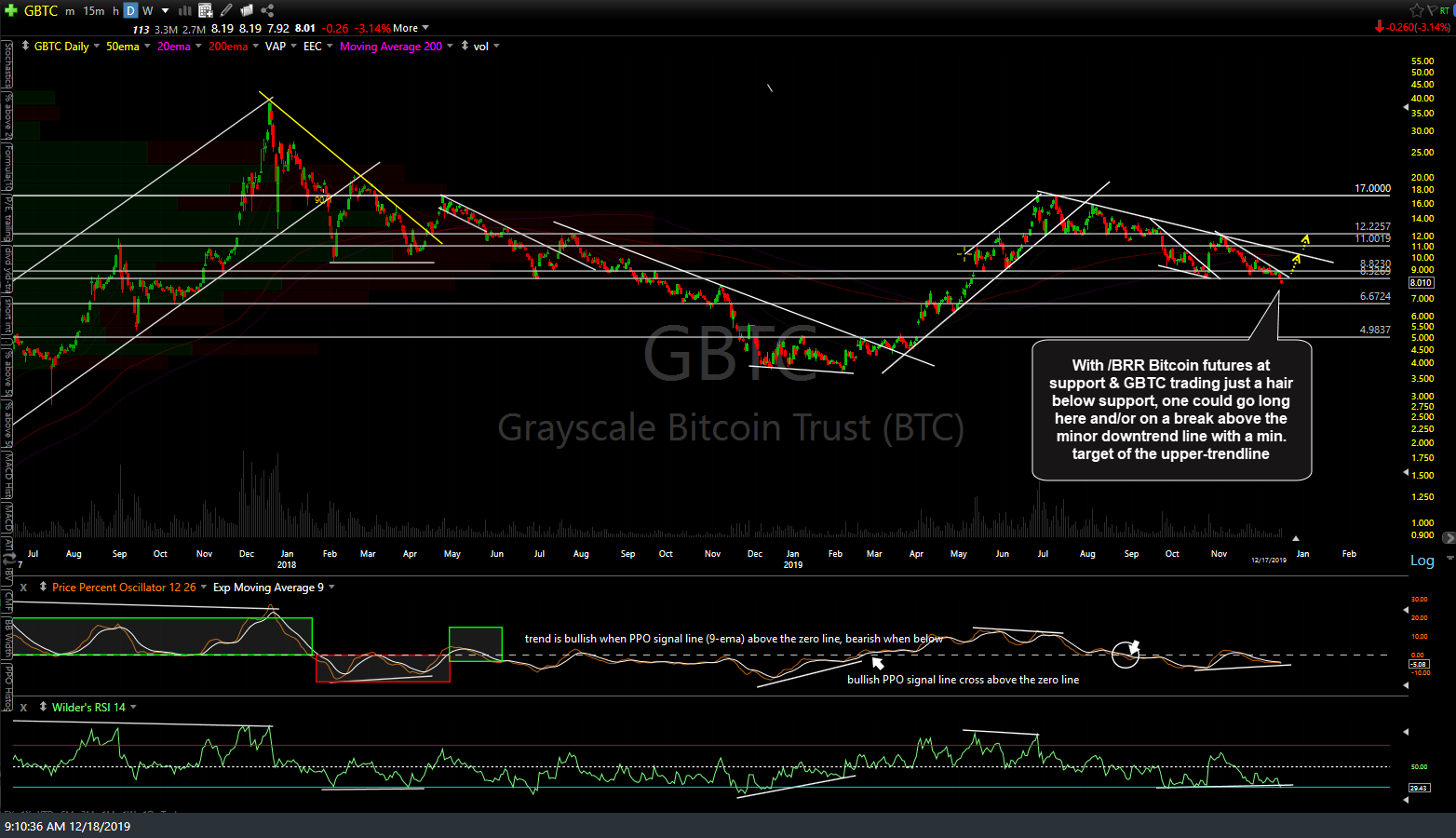

Another proxy for trading Bitcoin beside futures is GBTC (Grayscale Bitcoin Trust), which is similar to an ETF. With Bitcoin futures at support & GBTC (which trades at a premium or discount to Bitcoin, which is where it differs from an ETF that will always directly track the price of the underlying index or sector) currently trading just a hair below comparable support, a case could also be made for an objective long entry here (partial or full position) and/or on a break above the minor downtrend line. The minimum target would be the upper (larger) downtrend line with the potential for an additional buy signal to come on a solid break above that trendline, should GBTC get there.

This is an unofficial trade for now as Bitcoin is solidly entrenched in a downtrend without any buy signals at this time (going long at support if the charts confirm is objective although it is not a buy signal, such as a breakout above a bullish chart pattern or resistance level; a bullish candlestick reversal pattern; etc..). If the case for a reversal starts to firm up soon, I will consider adding GBTC as an official trade idea & if so, specific price target(s) will follow.