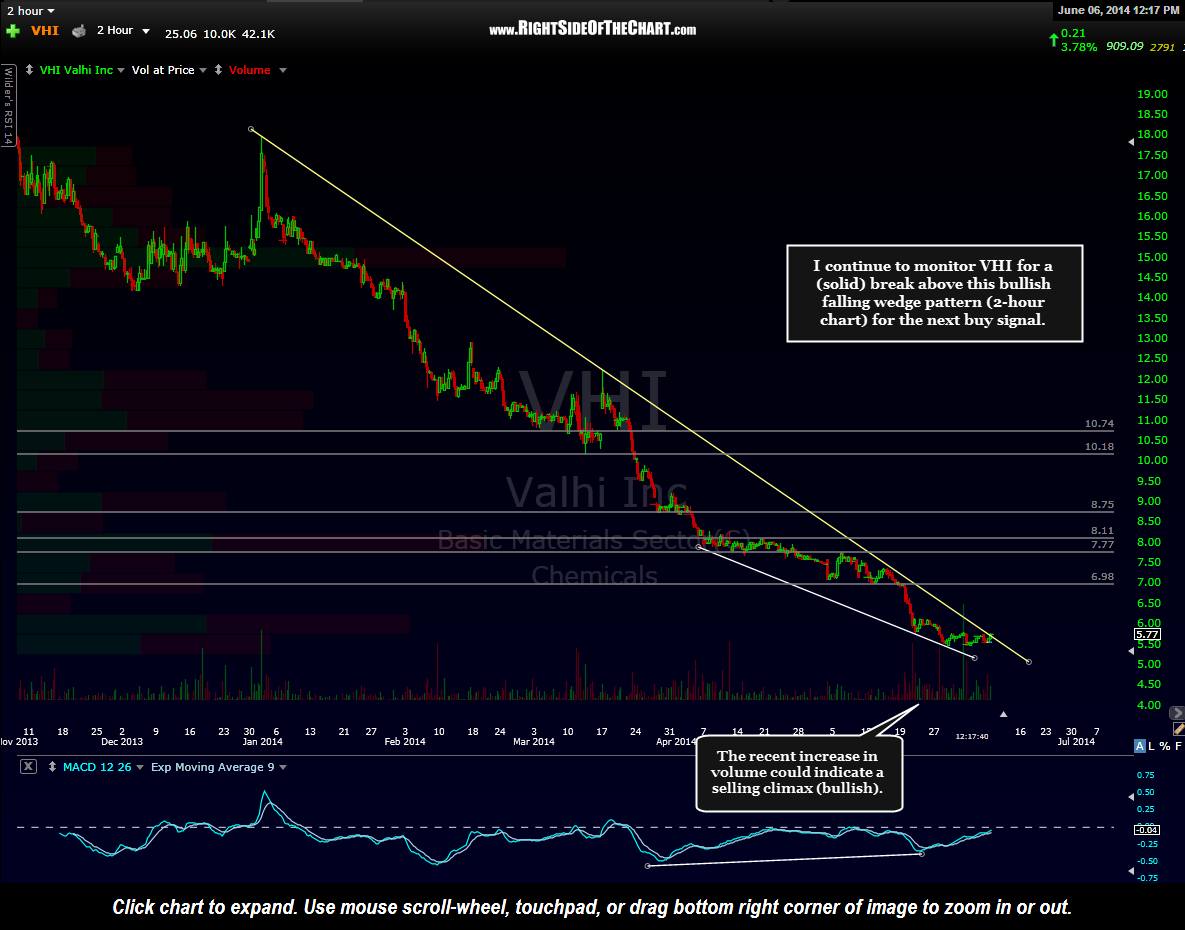

The VHI (Valhi Inc) long trade looks poised for a breakout which would trigger a long entry or add-on to an initial position. Once again, this is a low-volume, high-risk/high-reward trade and as with all low-volume stocks, limit orders are preferable over market orders due to the large spreads (which tend to narrow when trading volumes increase). The horizontal lines on this 120-minute chart represent some (relatively) near-term resistance levels which can serve as price targets for short-term traders. The typical swing targets remain as posted on the daily chart shown in the last update (click here to view or click on the VHI tag at the bottom right corner of this or any VHI related post).

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}