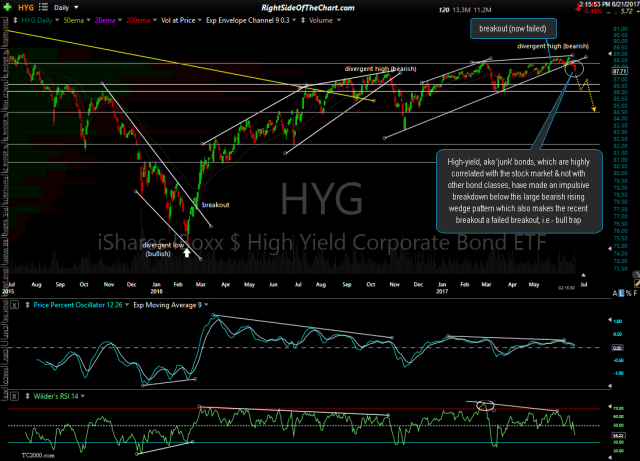

High-yield, aka ‘junk’ bonds, which are highly correlated with the stock market & not with other bond classes, have made an impulsive breakdown below this large bearish rising wedge pattern in HYG (High Yield Corporate Bond ETF) which also makes the recent breakout a failed breakout, i.e.- bull trap. As the performance of junk bonds is much more dependent on the economy than interest rates, as with other bond classes, high-yield (junk) bonds have an extremely tight correlation to the stock market due to the fact that default rates rise when the economy weakens.

- HYG daily June 21st

- HYG vs $SPX daily June 21st