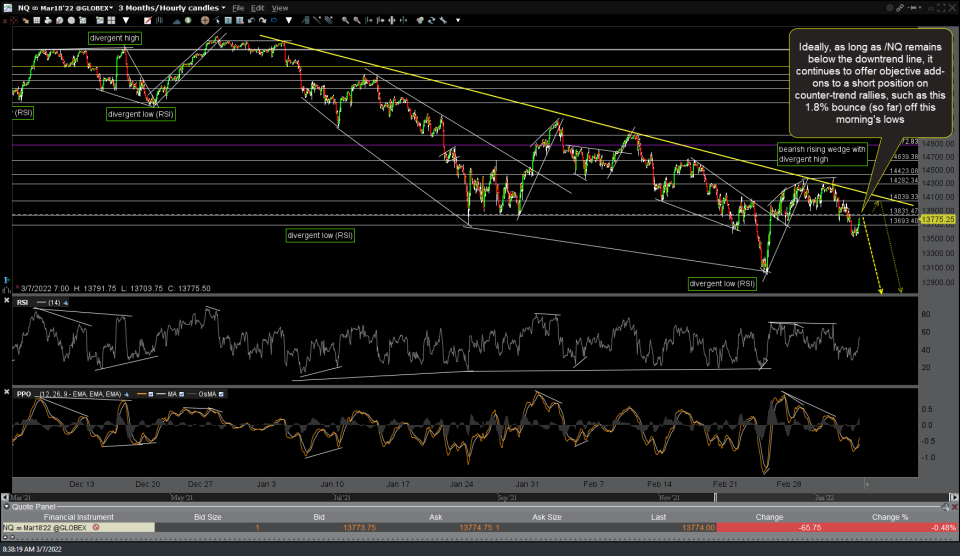

Ideally, as long as /NQ (Nasdaq 100 futures) remains below the downtrend line, it continues to offer objective add-ons to short positions, including QQQ & SQQQ, on counter-trend rallies, such as this 1.8% bounce (so far) off this morning’s lows. 60-minute chart below.

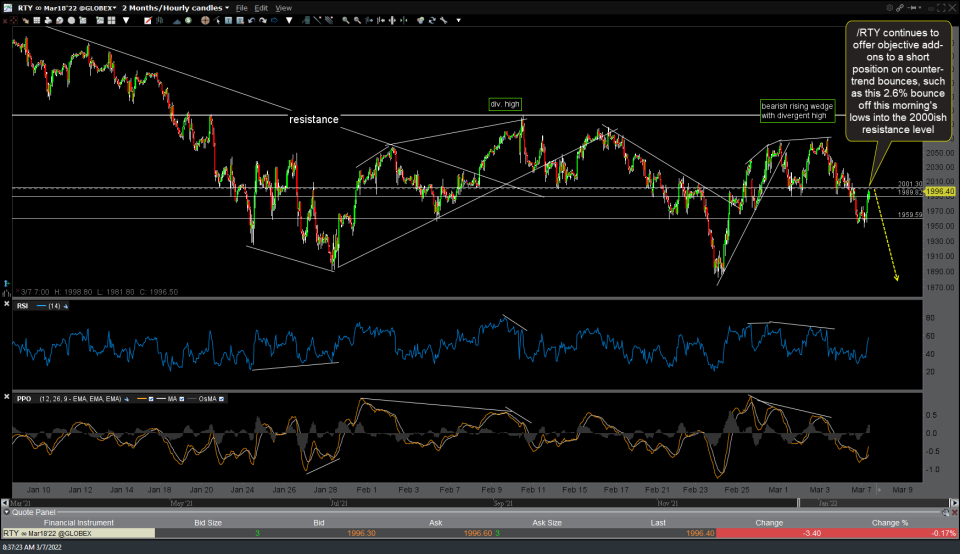

/RTY (Russell 2000 futures) continues to offer objective add-ons to short positions, including IWM & TZA, on counter-trend bounces, such as this 2.6% bounce off this morning’s lows into the 2000ish resistance level. 60-minute chart below.

This ~2% pre-market session bounce off the early-hours/overnight lows in the Globex trading session, along with the sharp 10% drop in crude futures from yesterday’s spike high without any accompanying news reeks of government intervention. Maybe, maybe not but ultimately, the stock market will go where the charts & fundamentals dictate. While I do suspect the Biden administration will be likely be forced to at least partially & possibly temporarily walk back some of the restrictions on oil production in the US sooner than later, barring a huge drop in crude (e.g.- back below $80), I suspect it will be too little, too late as demand destruction with $100+BBL oil has almost certainly already begun, not to mention the impact of soaring commodity prices across the board. QQQ 60-minute chart with pre-market session trades in white below:

Counter-trend rallies during major corrections & bear markets can be & usually are very strong & swift, as are the ensuing legs down to new lows. While we’ll only know definitely in hindsight once a bearish trend (correction or bear market) is over, at this point in time, the vast majority of technicals confirm that the trend off the late-2021 highs remains bearish & as such and until & unless we start to get some half-decent evidence to the contrary, counter-trend rallies, particularly those back to key resistance levels, provide objective shorting opportunities just as pullbacks to support in a bullish trend provide objective long entries.

With that being said, as per my recent analysis, we still need to take out the February 24th lows in order to increase the odds that my next downside swing/trend targets on the stock indexes will be hit. As of now, the market is still somewhat comfortably above those lows by about 5-6%.