In the trading room yesterday, member @dpatel had asked for my opinion on BLKCF, Global Blockchain Technologies Corp. As BLKCF is an OTC (over-the-counter) traded stock with very little price history & low volume (until just the last week or so), it is nearly impossible to render an opinion using technical analysis.

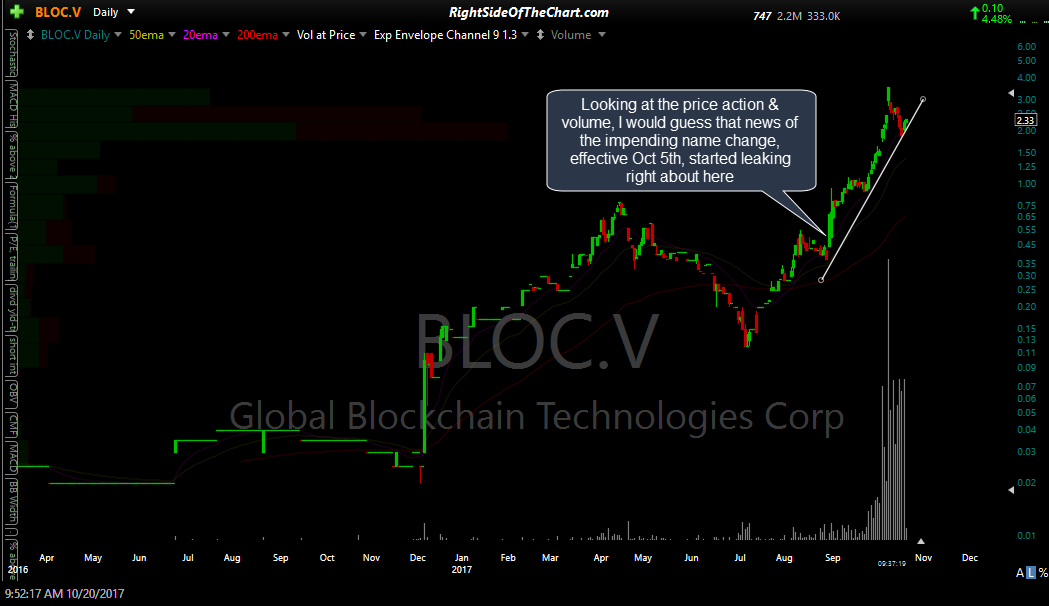

Again in the trading room earlier today, member @stock51 posted that Global Blockchain Technologies was up 16.72% yesterday. That, coupled with an article that I read last night, prompted me to pull the chart again in which I noticed that the company also trades on the Canadian Venture Exchange under the ticker BLOC.V. Those shares have a much better chart as there is more volume & the candlesticks are better developed than those on BLKCF. With that being said, I still don’t have much of an opinion on where the stock is headed.

Regarding the seemingly impressive 16.72% gain on the OTC traded shares yesterday, keep in mind that a 17% daily gain or loss in this stock is well within the normal daily price range. Back in late August, the stock had two consecutive days where it had intraday price swings of about 80 & 90% as well as a 45% gain just a couple of weeks ago. Point being that daily price swings on a stock are relative (to the average daily swings) & unless a large price move results in a technically significant development (i.e.- break of support, resistance, chart pattern, etc..), it is just “noise” if it is within the typical daily price swings of that stock.

On a final note, last night I read this article on the WSJ.com that discusses bubbles, largely focusing on the cryptocurrency bubble. I’d recommend reading it for those that have a subscription but also wanted to share this excerpt from the article:

Mature themes are more about earnings prospects and less about bubbles. But investors thinking about three big themes—bitcoin and blockchain; artificial intelligence, or AI; and treatment of aging—would do well to learn from the China experience.

The three are on a spectrum of frothiness. At the clearly bubbly end is anything cryptocurrency-linked, in which the joyous echoes of bubbles past are being heard by millennials. As in 1999 with dot-coms, a mere change of company name to something blockchain-related can boost the stock price. (source: WSJ.com)

Sure enough, a quick web search on the company yielded the following headline:

Vancouver, British Columbia, Oct 04, 2017 (Newsfile Corp via COMTEX) — Carrus Capital Corporation (CHQ) (the “Company” or “Carrus”) announces that further to its news release on September 28, 2017, it has received TSX Venture Exchange approval to change its name to Global Blockchain Technologies Corp.

At the opening of trading on October 5, 2017, the Company will trade under its new name of Global Blockchain Technologies Corp. and a new trading symbol of BLOC. (source: MarketWatch.com)

Bottom line is that chasing a stock that has jumped 850% in just 6 weeks on a simple name change to Global Blockchain Technologies Corp (assuming there wasn’t a legitimate fundamental catalyst responsible for the recent rally, which I have not checked for) is akin to playing a game of musical chairs. As long as the music keeps playing, you should be fine. Just make sure that you aren’t the last one standing when the music stops as when a bubble finally pops, the ensuing fall is often more swift than the move leading up to the top.