Over the years, I have found that Bitcoin & the Bitcoin proxies, or stocks or ETFs that tend to trade with a positive correlation to Bitcoin, both A) Tend to trade very well to the technicals (charts) and B) Tend to produce relatively quick & outsized gains compared to most other securities. Bitcoin futures (/BRR) have been trading in a mostly sideways, sloppy trading range since early May with some technical cross-currents. /BRR is backtesting the downtrend line (support) following the recent break below the uptrend line after putting in a divergent high just shy of the 10854 resistance level on the daily chart below. It appears that the uptrend off the mid-March low has either run its course or will do so soon, possibly with one more thrust up to test the 10854 level.

GBTC (Bitcoin Trust, which tracks the price of Bitcoin) recently had a failure at the downtrend line followed by a break below the uptrend line after the recent divergent high on GBTC. A solid break below the 10.09ish support would likely spark another wave of selling in Bitcoin.

Essentially, I am cautiously bearish on Bitcoin as well most of the Bitcoin proxies that have been posted as trade ideas here the past, in large part due to the even more clearly bearish technical developments on the charts of the latter, starting with OSTK (Overstock.com), which is on watch for the next sell signal & swing short entry following this most recent divergent high & overbought conditions.

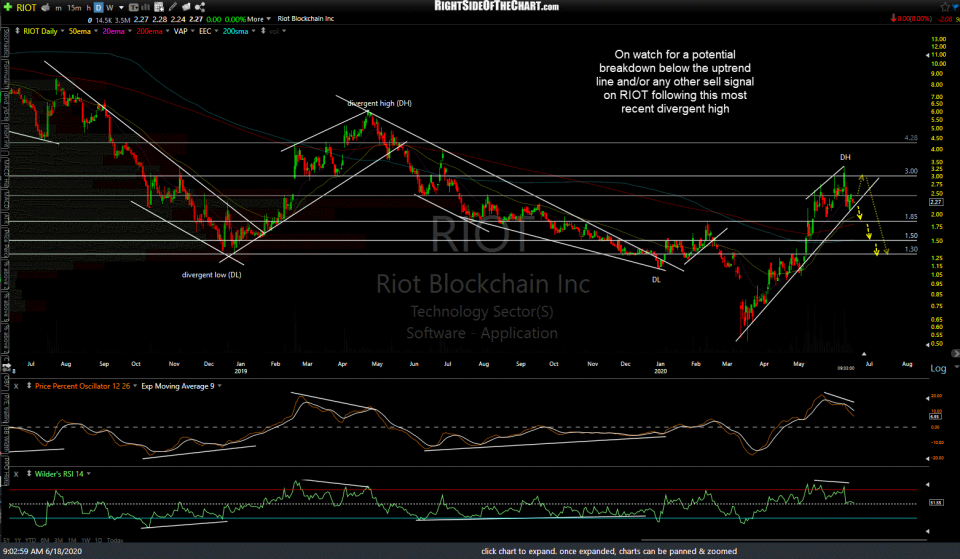

On watch for a potential breakdown below the uptrend line and/or any other sell signal on RIOT (Riot Blockchain Inc.) following this most recent divergent high.

While a very aggressive trade idea due to the low share price & volatile trading history, HVBTF (HIVE Blockchain Technologies) appears poised for a 30%+ drop should it break below the uptrend line & 0.2378 support level with conviction. Should the stock make a marginal new high anytime soon, it would be a divergent high, setting the stage for a potentially larger drop.

Bottom line: I am passing these along as unofficial trade ideas & trade setups at that (i.e.- potential trades awaiting an objective short entry/sell signal). I’d like to see a little more in the charts of /BRR & GBTC as the trend in both the stock market as well as the Bitcoin proxies above has been very resilient lately. However, I did want to pass these setups along in advance & will follow up with specific trade parameters (price targets, entry points, suggested stop, position size considerations, etc..) should I decide to make any or all of these official trades.