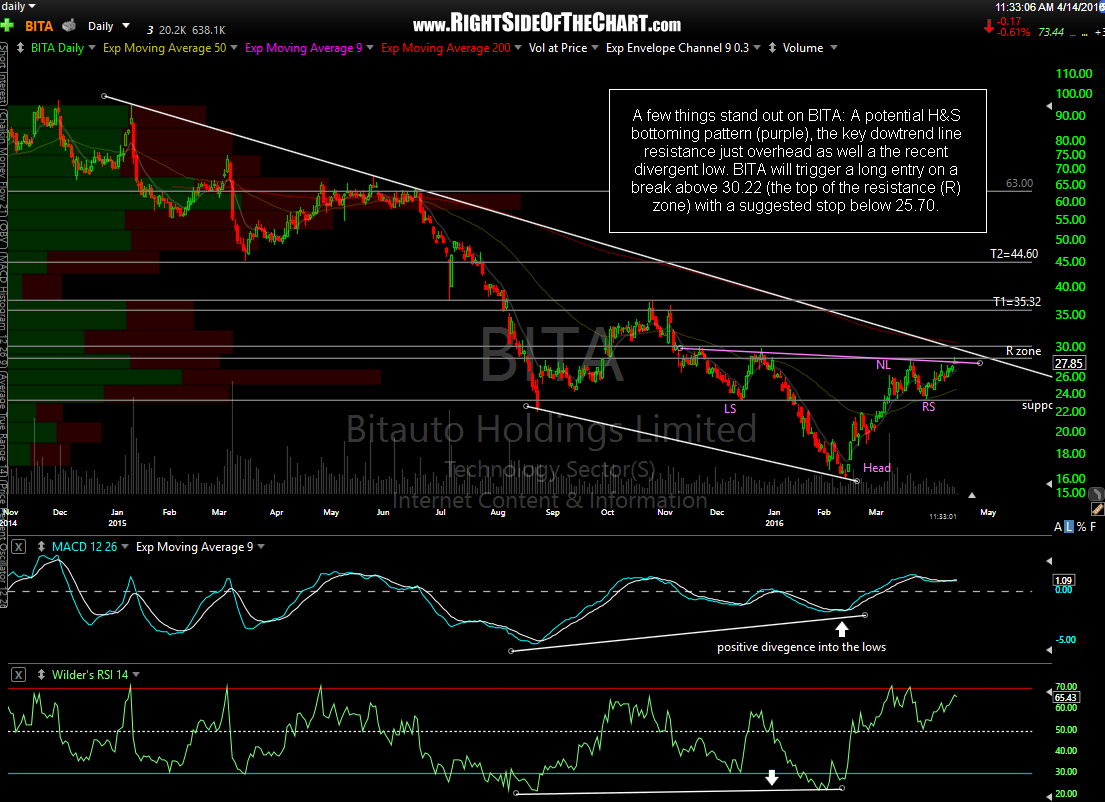

A few things stand out on BITA (Bitauto Holdings Ltd): A potential H&S bottoming pattern (purple), the key downtrend line resistance just overhead as well a the recent divergent low. BITA will trigger a long entry on a break above 30.22 (the top of the resistance (R) zone) with a suggested stop below 25.70. Props to member @hiddenpivots for pointing this one out.

BITA Trade Setup

Share this! (member restricted content requires registration)

3 Comments