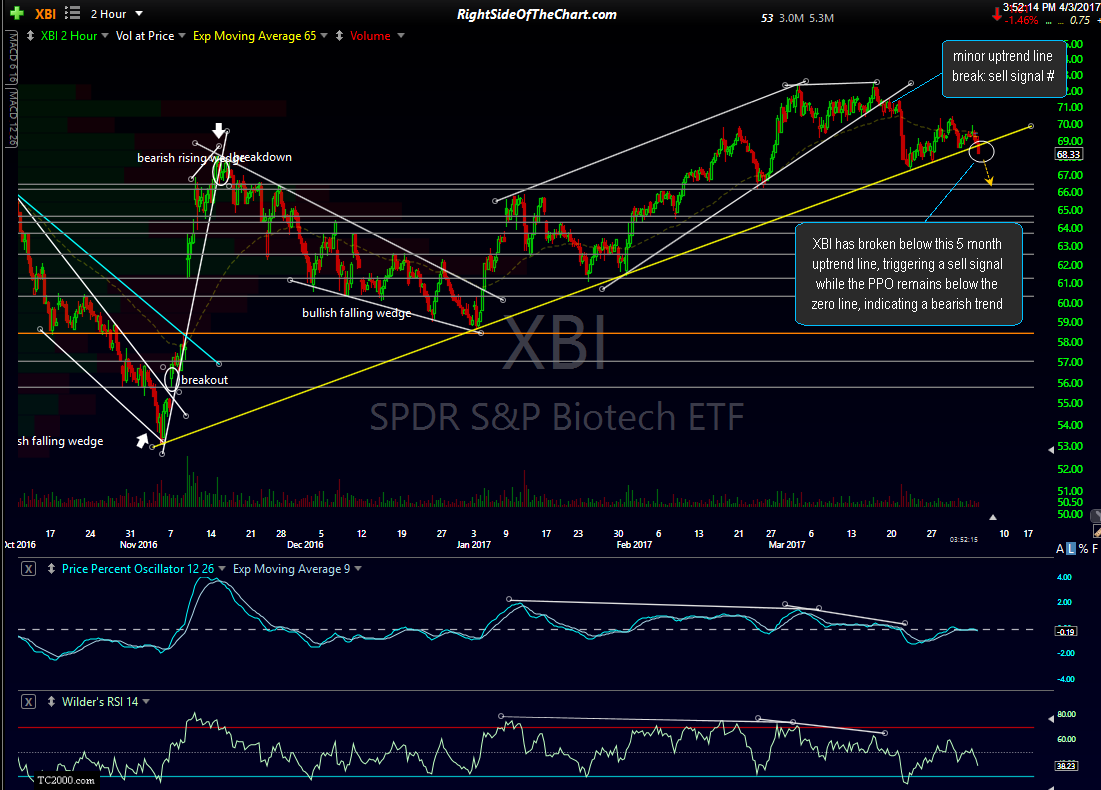

XBI (Biotech ETF) has broken below this 5 month uptrend line, triggering a sell signal while the PPO remains below the zero line, indicating a bearish trend. I am holding off from adding XBI or any of the other biotech ETFs as official trade ideas for now, preferring to see additional bearish confirmation in the broad markets as well as follow-through to the downside on XBI tomorrow. 120-minute chart:

Biotech Stocks Break Support

Share this! (member restricted content requires registration)

6 Comments