Another busy day managing my trades along with posting updates & videos on the site so I will reply to emails as well as questions, comments & chart requests within the trading room asap. Before then, I just wanted to reiterate my bearish outlook for crude oil in the coming weeks & months & share this chart of DWT (3x inverse/short crude oil ETN) for those interested. I mentioned shorting /CL (crude futures) last week & plan to let that position ride for the foreseeable future with relatively loose trailing stops in place.

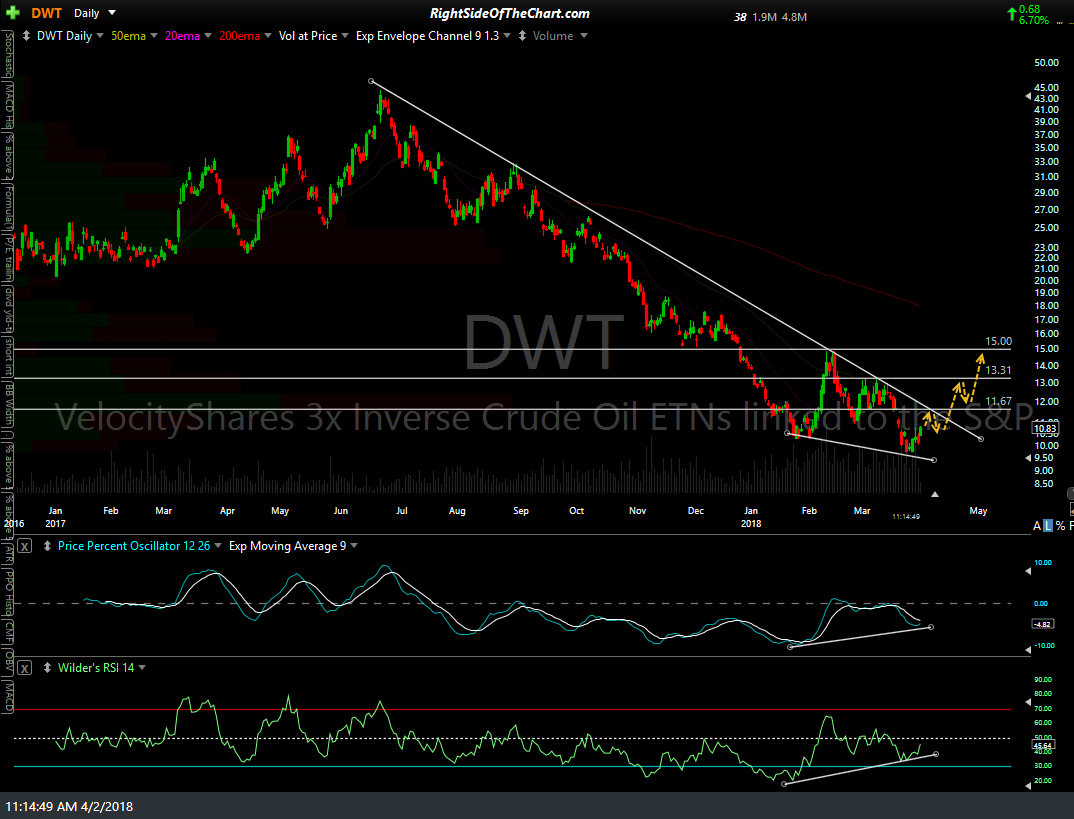

DWT or some other direct (i.e.- crude tracking ETNs) and indirect (oil stocks & energy sector ETFs) will likely be added as official trade ideas soon but until then, this chart of DWT shows a clear bullish falling wedge pattern, which would be a bearish rising wedge on crude if flipped upside down, confirmed with bullish divergences on the PPO & RSI. The price levels show, along with the downtrend line, are the actual resistance levels. If I add DWT as an offical trade idea, I will list specific price targets set just below those resistance levels. More on crude & the energy sector to follow soon.