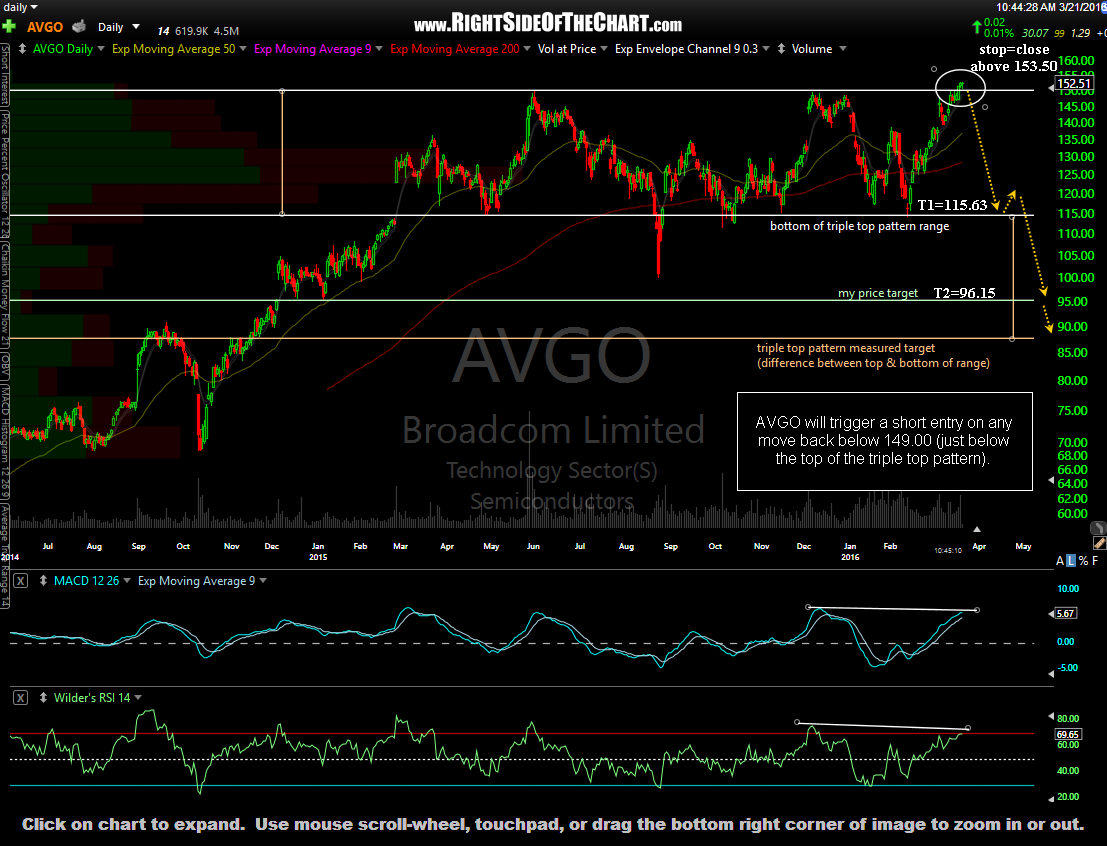

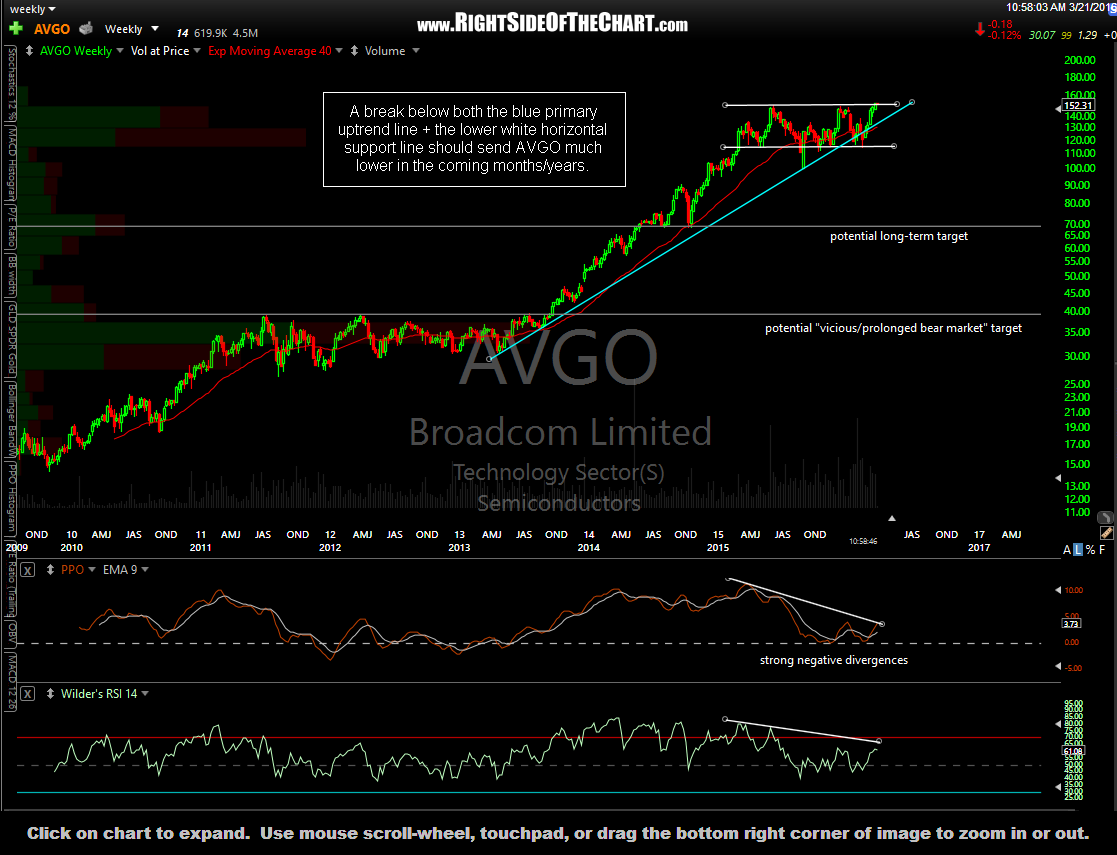

Kudos to @snipertrader for pointing this one out in the trading room. AVGO (Broadcom Limited) will trigger a short entry on any move back below 149.00, which is just below the top of the triple top pattern shown on the daily chart below. AVGO just recently experienced a marginal breakout above triple-top resistance. While bullish on face value, this recent breakout comes on a divergent high plus mediocre volume.. not below average, but not impressive either. Factor in the 60-minute rising wedge & I’d put good odds that this proves to be a bull trap/false breakout.My two price targets, as well as the measured target for the triple top pattern, are shown on daily chart. T1=115.63, T2 (current final target)=96.15 with a suggested stop on a daily close above 153.50.

This fully mature 60-minute bearish rising wedge pattern, confirmed via divergences, looks ripe for a breakdown. A breakdown below this 60-minute wedge & the first (horizontal) support level below, should it occur, will coincide with a move back down below the triple top breakout, considerably adding to the bearish case for Broadcom.