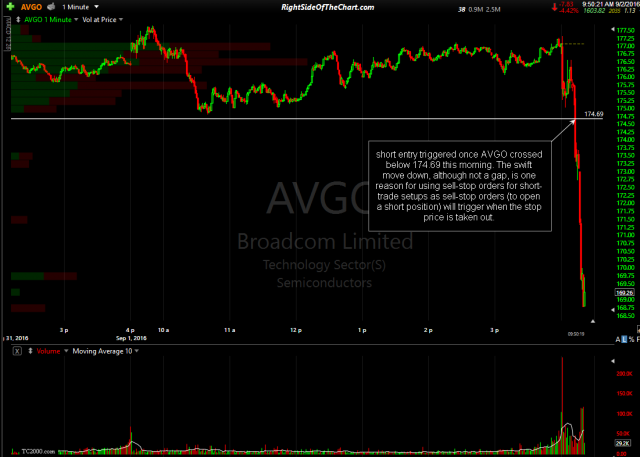

The AVGO (Broadcom Ltd) short trade setup has triggered a short entry today on a move below 174.69. This one minute chart shows that the short entry triggered once AVGO crossed below 174.69 this morning. The swift move down, although not a gap, is one reason for using sell-stop orders for short-trade setups as sell-stop orders (to open a short position) will trigger when the stop price is taken out.

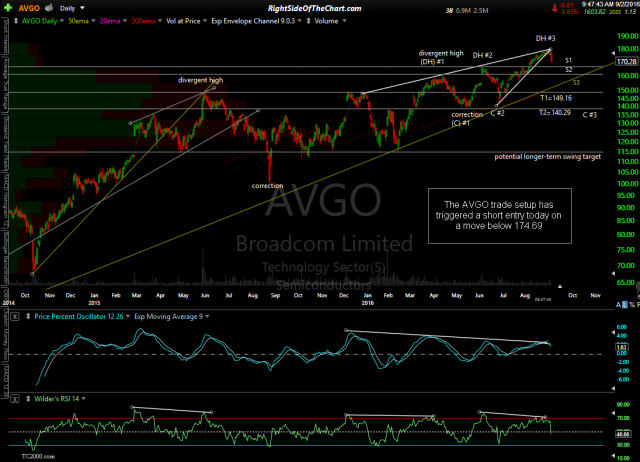

- AVGO daily Sept 2nd

- AVGO 1-minute Sept 2nd

The trade parameters remain the same with a suggested stop over 186.00 & price targets at T1 (149.16) and T2 (140.29 with a potential longer-term swing target around the 115.00 support level which may be added, depending on how the charts of AVGO & the broad market play out going forward.