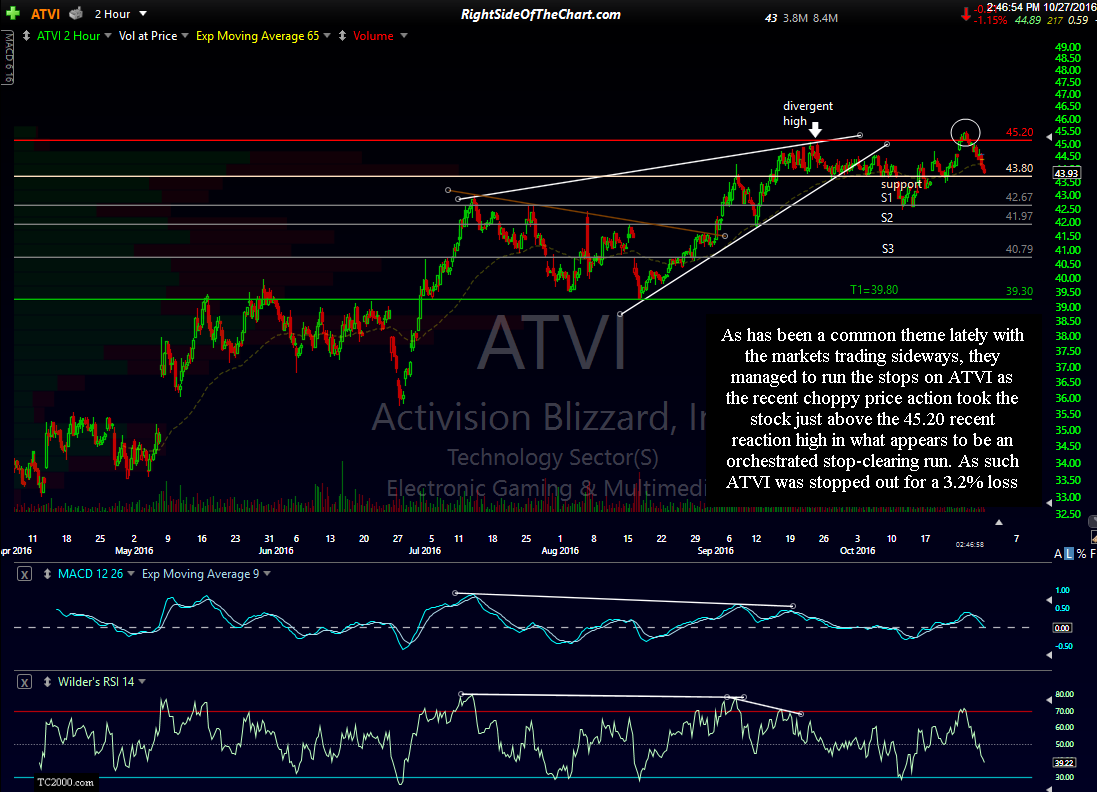

As has been a common theme lately with the markets trading sideways, they managed to run the stops on ATVI as the recent choppy price action took the stock just above the 45.20 recent reaction high in what appears to be an orchestrated stop-clearing run. As such ATVI was stopped out for a 3.2% loss.

I will add that I still very much believe that ATVI looks to be a promising short trade with large profit potential in the coming months & as with some of the other trades that recently had their stops briefly clipped, ATVI may soon be added back as another official short trade. Despite the recent “noise” on the shorter time frames due to the choppy price action in the broad markets, the bigger picture on ATVI is very clear to me: A breakdown below a very large bearish rising wedge with prices back-testing the wedge from below for the last couple of weeks. The charts below are both weekly charts, the first a 10-year weekly followed by a zoomed in picture that helps to highlight the recent breakdown & backtest of the wedge.

- ATVI weekly Oct 27th

- ATVI weekly zoomed Oct 27th

Yesterday I was asked in the trading room if I give my trades more room on the stops & the answer to that question is yes, sometimes I do allow wider stops on my personal trades than the official stops just as I will sometimes continue to hold a position after the final official price target has been hit (and sometimes close my trades before the final target is hit). As explained in the FAQ page on RSOTC, I don’t take every trade idea that is posted, although I do personally take the majority of them, just as I also take many trades that are not official or even unofficial trade ideas.

The suggested price targets & stop-loss level are just that, general suggestions that are based on several variables including R/R ratios, chart pattern measure targets, support & resistance levels, etc… Each trader or investor should use stops & price targets that are commensurate with their own unique trading style and risk tolerance as well as deciding on which trades mesh with their trading style & objectives & passing on those that don’t.