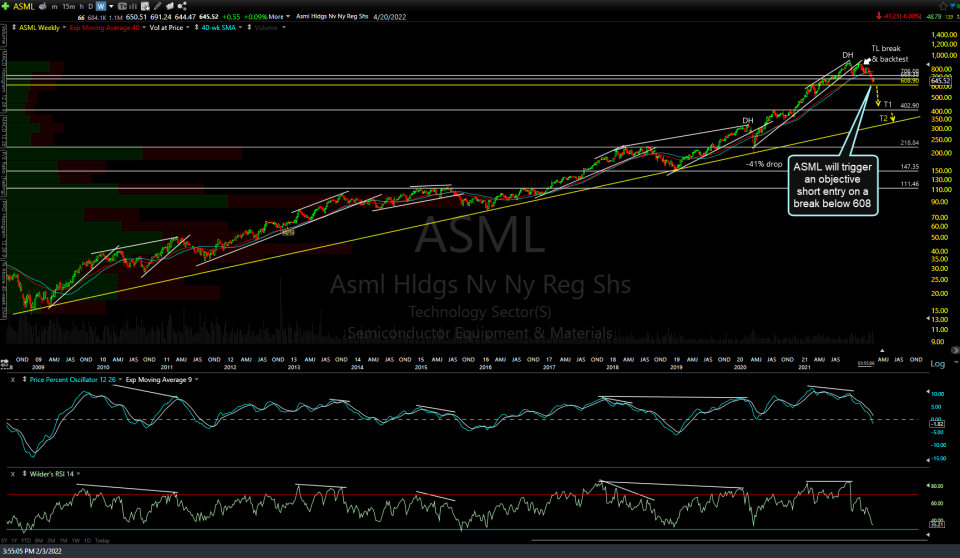

ASML (ASML Holdings) will trigger an objective short entry on a break below 608. Once again, I am using the weekly chart in order to show the bigger picture including the well-defined primary trendlines on many of these semiconductor stocks, most of which come off the late 2008/early 2009 bear market lows (beginning of the current cyclical bull market).

So far, ASML is the third individual semiconductor stock trade idea that I’ve posted today & so far, I’m just going down the list of the holding of SOXX (semiconductor sector ETF), sorted market cap in descending order. Bottom line, the charts on most semis appear very similar as the individual components of that sector tend to have a fairly tight positive correlation (i.e. -birds of a feather flock together). As such, one might opt to just short SOXX, XSD, SMH, or go long (buy) an inverse sector ETF such as SOXS (-3x ICE semiconductor index*).

*In previous videos, I stated that SOXS & SOXL (+3x bull) tracked the PHLX Semiconductor Sector Index, $SOX). However, I just noted on Direxion’s website that they changed the underlying index from the $SOX to the ICE Semiconductor Index on or about August 25, 2021. Regardless, the semis (and the various semiconductor sectors) tend to move in concert so SOXS should still work well “IF” we get a fairly unidirectional drop in the semis without a long of counter-trend rallies and/or sideways trading ranges before my targets are hit. SSG is the -2x bearish semi ETF with a lower leverage factor of 200% for those interested.