Member @foolstone requested my opinion on DBA (Agricultural ETF) & COW (Livestock ETN) & I figured that I’d thrown in my analysis on CUT (Timber ETF) while I’m at it.

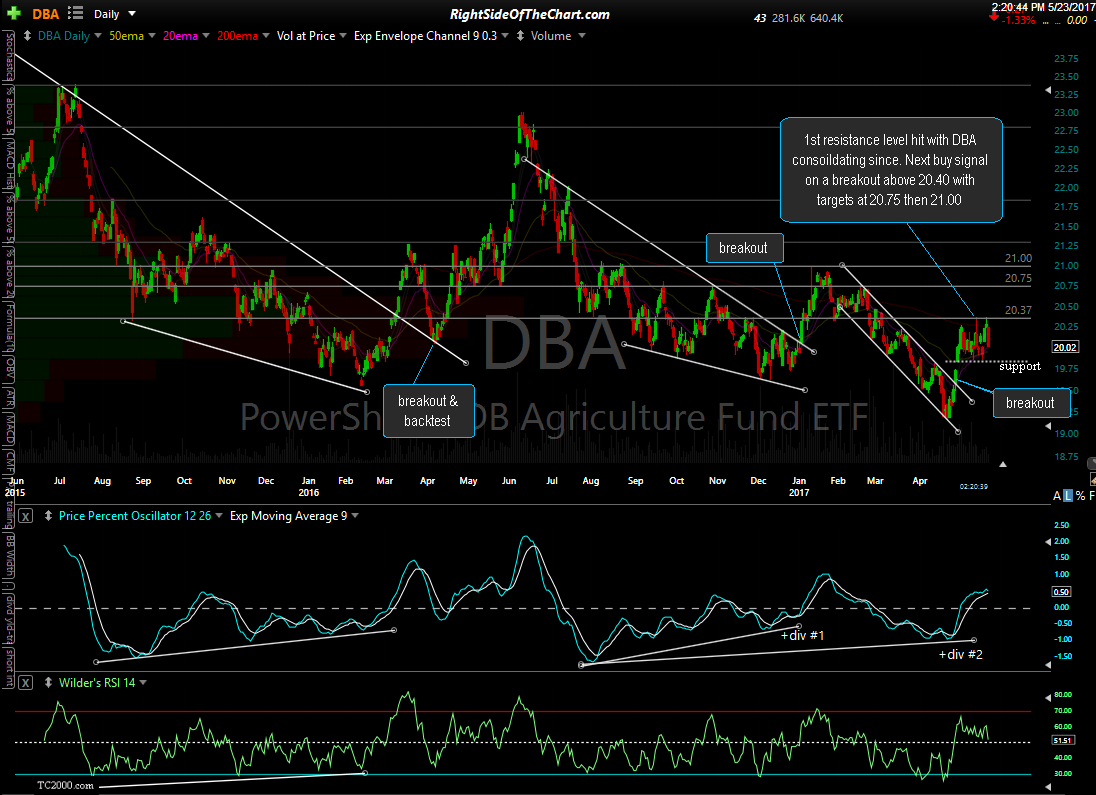

DBA recently broke out above a descending price channel following a divergent low, rallying up to the 20.40ish resistance level & has been consolidating just below since. I view the recently consolidation has constructive as it has helped to alleviate the overbought conditions & should allow for a more sustained rally should DBA go on to break out above the 20.40ish level soon. The dotted horizontal support line around 19.87 has contained all pullbacks since that first target/resistance level was hit & although DBA may or may not get there again, if it does, that would provide an objective long entry with a stop placed somewhat below 19.75 which is the bottom of the April 28th gap.

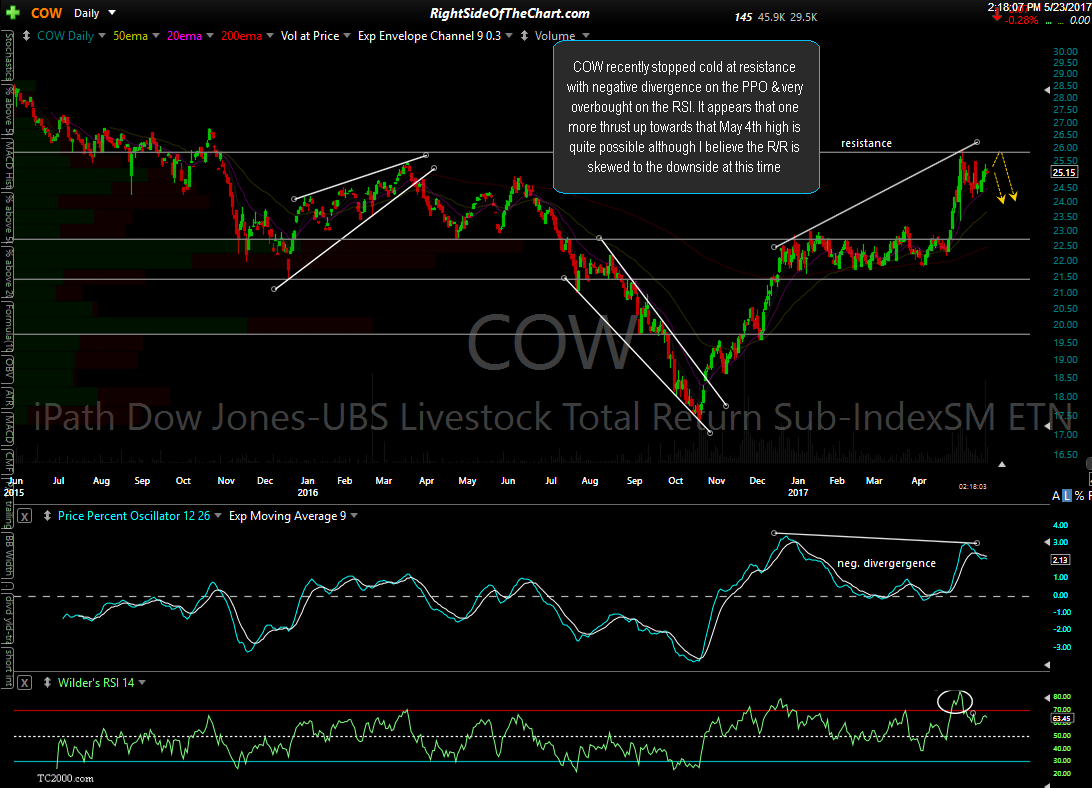

While I’m near-term neutral & intermediate/long-term bullish on DBA, my outlook for COW somewhat tempers my bullishness on DBA. COW is comprised of 61.37% state in Live Cattle & a 38.63% weighting in Lean Hogs. DBA has a 17% weighting in Live Cattle & a 10% weighting in Lean Hogs, as such, COW accounts for about 17% of the performance of DBA , a substantial overlap. COW recently stopped cold at resistance with negative divergence on the PPO & very overbought on the RSI. It appears that one more thrust up towards that May 4th high is quite possible although I believe the R/R is skewed to the downside at this time.

My conviction isn’t very strong on where COW is headed & it is quite possible that it is currently bull flagging (no pun intended) on the daily chart above & if so, an impulsive breakout above the flag as well as the 25.85ish resistance level could send the ETN quite a bit higher, even taking out the divergence that is in place on the PPO at this time. One other possibility that I can foresee would be a sideways consolidation below the 25.85ish resistance for a while with COW eventually breaking above that level & sparking the next leg higher in a bull market that started back in October. Regardless, the bulk of the remaining 83% of DBA is made up of various agricultural commodities which appear to be setting up for potential bullish trend reversals such as corn, soybeans, wheat, sugar, cocoa & coffee.

One commodity ETF that clearly appears to be setting up for a correction is timber. CUT (Timber ETF) looks like it’s about to get chopped down on a break & close below this bearish rising wedge pattern & the 26.80ish support level. The chart of WOOD (another Timber ETF) looks very similar. My expectation is for a drop of at least 6% & quite possibly 13% in the coming months. If my analysis proves correct, a drop in timber prices will likely coincide with a slow down in new construction/home building.