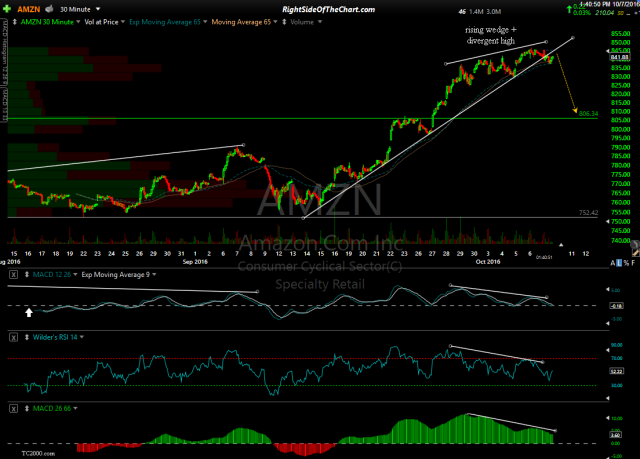

Exactly 10 days ago, I had predicted in the trading room that the undisputed King of the momentum stocks that has been lifting the leading index, the Nasdaq 100, would drop by over 4% by the end of the following week. While it looks like my timing was off by a few trading sessions, one of the remaining holdouts of the top, over-weighted components of the Nasdaq 100 (the 3rd largest component at a 7% weighting) seems to be playing out as expected so far, albeit just a hair behind schedule, following the recent breakdown below this bearish rising wedge pattern as seen on the 30-minute time frame.

- AMZN 30-minute Oct 7th

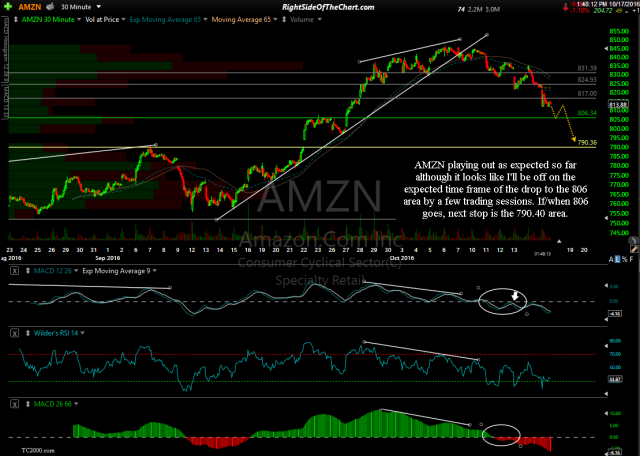

- AMZN 30-minute Oct 17th

While a reaction off the 806 area is likely, should that support level get taken out with conviction, a continued move down to at least the 790.40 area would be very likely. If so, such a correction in the leading stock of the leading index is very likely to have bearish implications as the selling would be likely to spillover into the other mega-cap stocks that seem to be doing most of the heavy lifting, or more accurately, holding up of the market in recent months. The key support levels to watch in the top components of the $NDX were covered in this Stock Market Analysis video posted last Thursday.