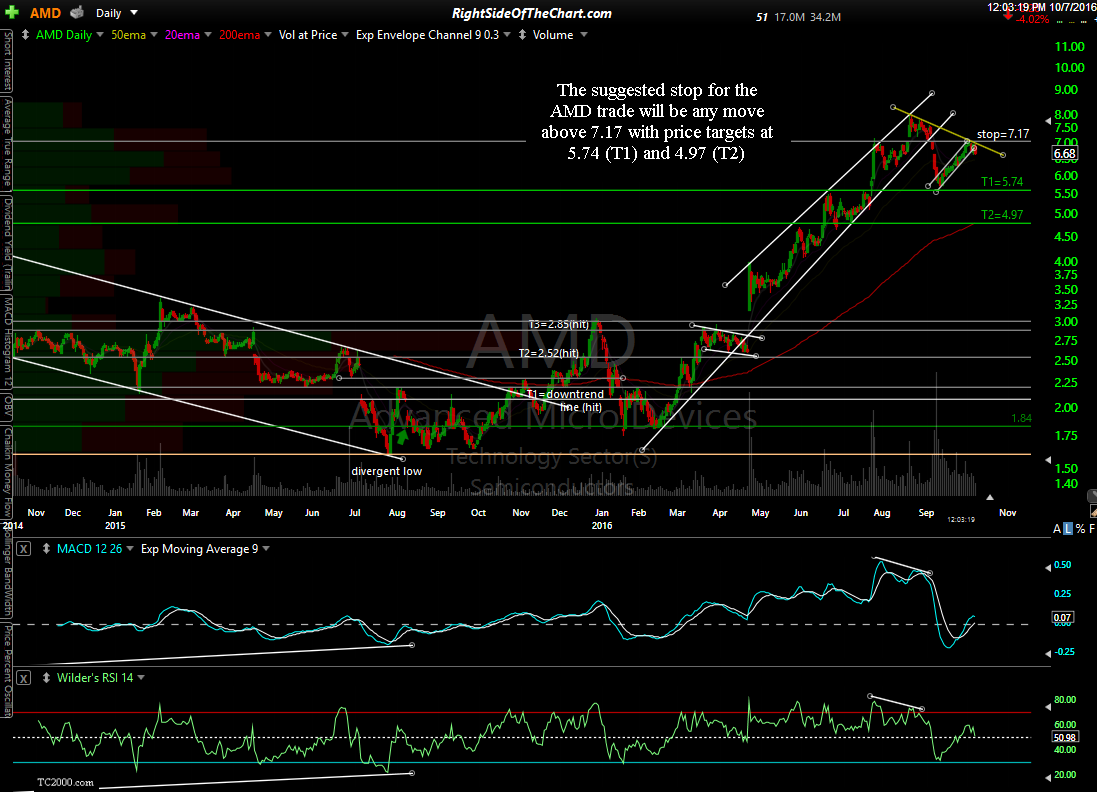

The suggested stop for the recently posted AMD (Advanced Micro Devices) short trade will be any move above 7.17 with price targets at 5.74 (T1) and 4.97 (T2).

AMD Price Targets & Suggested Stop-loss Levels

Share this! (member restricted content requires registration)

5 Comments