The charts of select agricultural commodities continue to firm up as compelling long-side trades. Some of these might be added as official long trade ideas soon but until then, I wanted to share the charts of a few that stand out at this time.

SOYB (Soybean ETN) still setting up for a likely trend reversal & rally with the next buy signal to come on a breakout above this bullish falling wedge pattern. So far, my recent scenario posted back on May 22nd (1st chart below) is playing out, with SOYB making one more thrust down within the wedge pattern & moving higher since.

- SOYB daily May 22nd

- SOYB daily June 6th

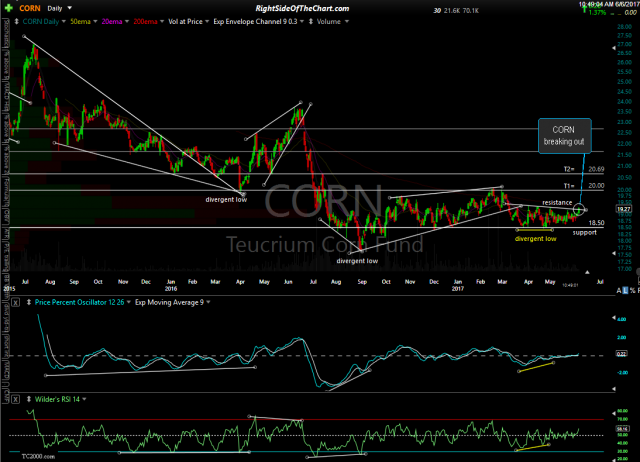

CORN (corn ETN) is breaking out today following the recent divergent low & looks poised for a rally to at least the 20.00 area.

- CORN daily May 22nd

- CORN daily June 6th

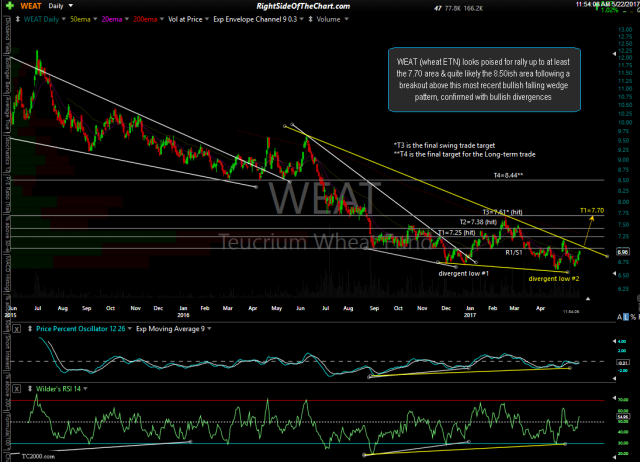

WEAT still looks poised to rally on a breakout above this large bullish falling wedge pattern.

- WEAT daily May 22nd

- WEAT daily June 6th

For those preferring the ease & simplicity of trading a single ETN for exposure to a portion of the agricultural commodities, grains, the chart of JJG (grain ETN) continues to firm up as well with JJG poised for a breakout above this bullish falling wedge pattern, confirm with positive divergences.