All three of the agricultural input stocks first highlighted as standout trade ideas in the June 2nd Market Wrap & Swing Trade Ideas video (and several updates since) continue to outperform the broad market, with potentially more meat on the bone left on at least two of those three stocks.

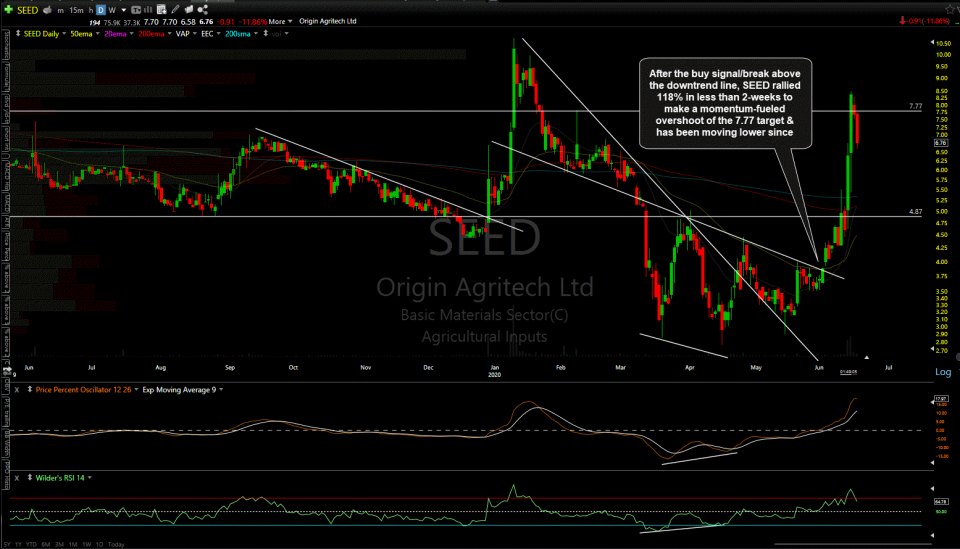

The run may be over for SEED (Origin Agritech), at least in the near-term, as the stock rallied 118% in less than 2-weeks following the buy signal/breakout above the secondary downtrend line to make a momentum-fueled overshoot of the 7.77 target & has been moving lower since. As the stock was extremely overbought on the daily time frame from that nearly vertical advance, it may need to continue to work off those overbought conditions, either in time and/or price before the next leg higher.

However, the weekly chart of SEED still appears constructive & the case can be made for a potential bottoming play in the stock with the potential as a bottoming play targeting any or all of the marked levels on the chart below.

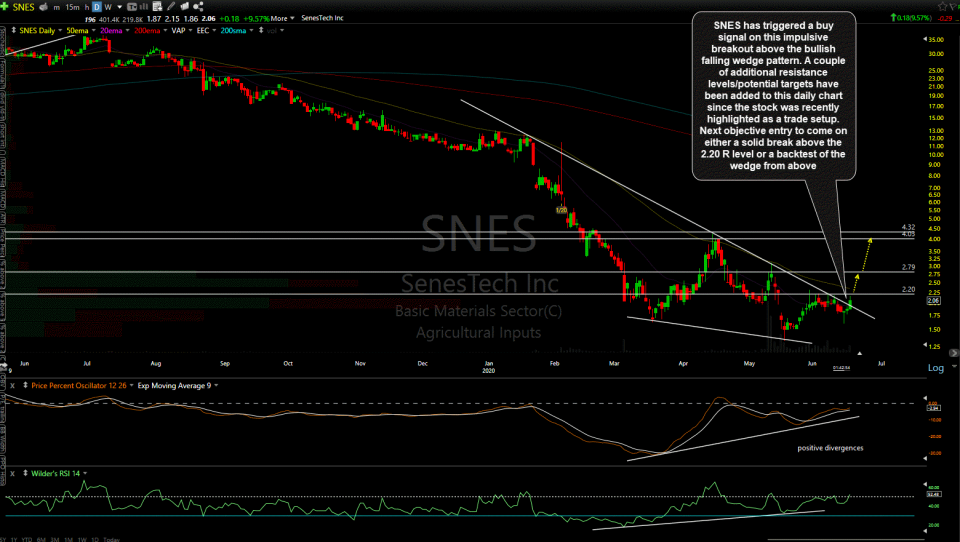

The SNES (SenesTech Inc) trade setup has triggered a buy signal on this impulsive breakout above the bullish falling wedge pattern. A couple of additional resistance levels/potential targets have been added to this daily chart since the stock was highlighted in recent videos. The next objective entry to come on either a solid break above the 2.20 resistance level or a backtest of the wedge from above.

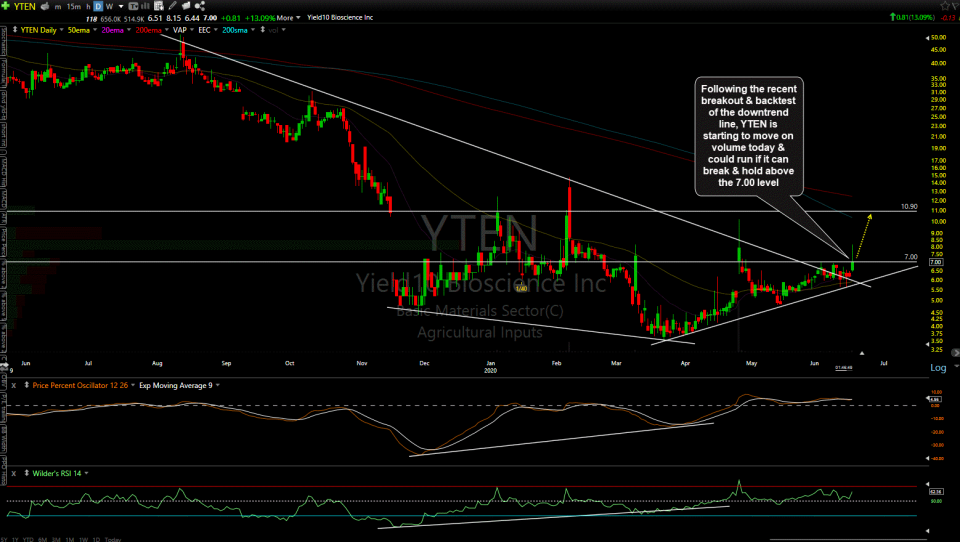

Following the recent breakout & backtest of the downtrend line, YTEN (Yield10 Bioscience Inc) is starting to move on elevated volume today & should continue to rally if it can break & hold above the 7.00 level. As of now, my sole price target (unadjusted target/actual resistance level, as these are unofficial trades) is 10.90.