ADP (Automatic Data Processing Inc.) will be added as an Active Short Trade idea with a max. suggested stop above 89.65. T2 (79.22) is the current final target although additional targets might be added. Ideal entry level is anywhere as high as 88.00 and a low as 86.00 (currently trading around 87.40).

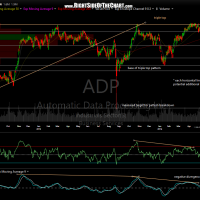

- ADP daily May 5th

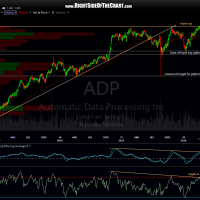

- ADP 2-day period May 5th

- ADP weekly May 5th

On the daily & 2-day period charts above, ADP has just rolled off the formidable 90.50ish resistance level, marking the third failure at that level in just over a year. The negative divergences in place on the MACD & RSI help to confirm the bearish nature of the potential triple top reversal pattern. On the 2-day period chart below, you can also see that the second failure at the highs was a backtest of the 2012-2015 primary uptrend line on ADP while the weekly chart only helps to affirm the longer-term bearish case as ADP is trading near the top of a very large bearish rising wedge pattern, complete with strong bearish divergences in place on both the PPO & RSI.