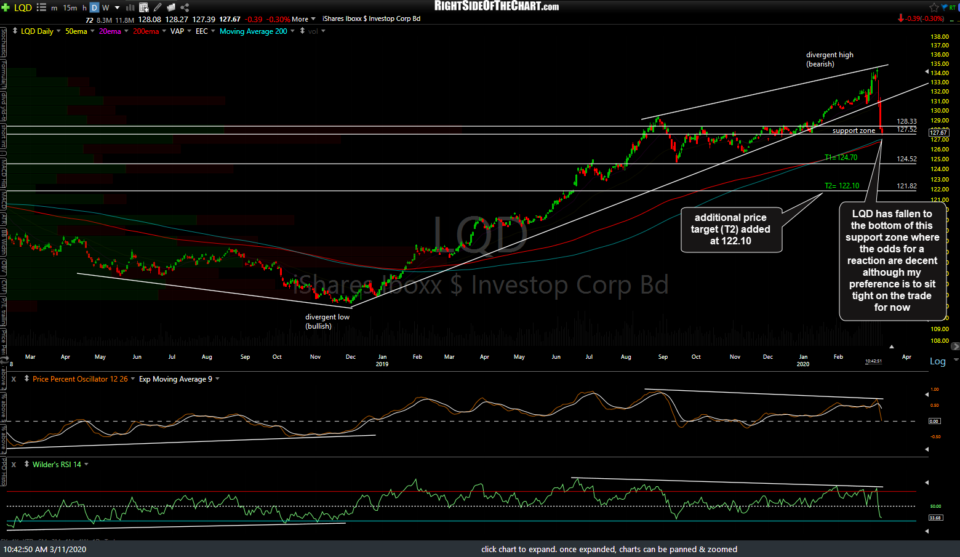

The selling following the anticipated breakdown below the primary uptrend line on LQD has been very impulsive which only helps to confirm the breakdown & indicate that LQD (investment-grade corporate bond ETF) will most likely have considerably more room to fall in the coming weeks to months with the typical counter-trend rallies along the way. As such, I have decided to add a second price target, T2, at 122.10 & still may add additional targets, depending on how the charts of both LQD & the equity markets develop going forward.

I should also point out that LQD is currently trading at the bottom of the first decent support zone that runs from about 128.33 down to 127.50 so the chances for a reaction here are decent. The LQD Active Short Trade is profitable by about 2½% or an effective 5% gain when factoring in the 2.0 suggested beta-adjusted position size (i.e.- a double-sized position based on the inherently low volatility and downside risk of investment-grade corp bonds, had this trade moved against us). As such, one could certainly book quick profits here although my preference is to sit tight for now, stick with the trading plan, and give the charts time to play out.