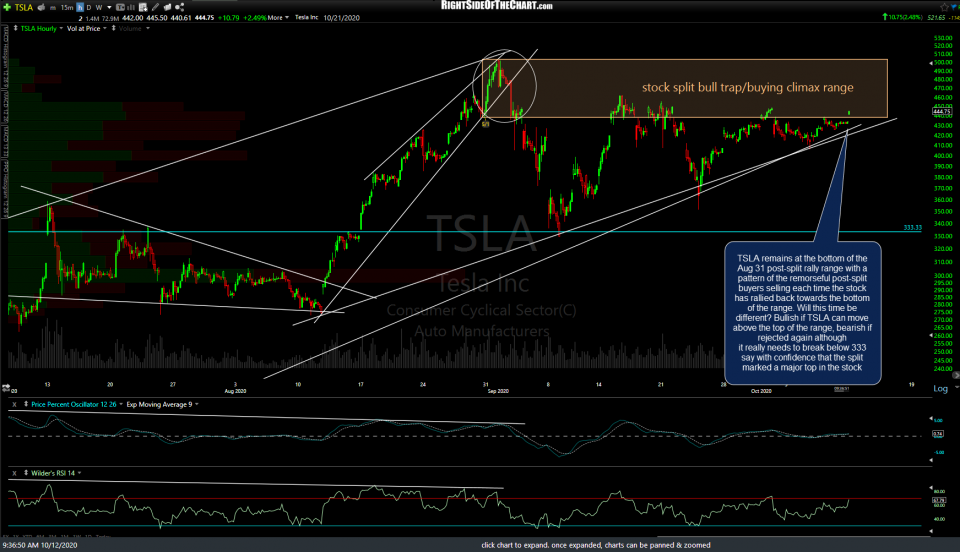

TSLA (Telsa Inc.) remains at the bottom of the Aug 31 post-split rally range with a pattern of the remorseful post-split buyers selling each time the stock has rallied back towards the bottom of the range so far. Will this time be different? Certainly possible & definitely bullish if TSLA can move above the top of the range while bearish if rejected again although it really needs to break below 333 say with confidence that the split marked a major top in the stock. 60-minute chart below.

While TSLA has made a few attempts to rally back into the post-split trading zone, AAPL (Apple Inc.) is backtesting the uptrend line off the March lows as it comes up for the first test of the bottom of the technically significant post-split potential buying climax range. AAPL is also testing the 50% Fibonacci retracement level of the move down following the post-split highs for the first time since the 25% drop following the post-split rally/potential buying climax. 60-minute chart below.

Bottom line: We still have the Nasdaq 100 at extreme near-term overbought reading on the 60-minute chart that indicates any more upside in the near-term is most likely limited before the market, along with the two $NDX components above, either correct or consolidate. While Friday’s breakout & subsequent rally above the recent trading ranges in QQQ & /NQ were most certainly bullish technical events, a decent case could be made that the nearly 6% rally since then was/is sufficient to account for the first leg up following the breakout, with the odds for corrective wave (or consolidation period) increasing substantially with each tick higher at this time.

I am also watching to see how AAPL & TSLA act as those post-split trading ranges are tested as it would certainly be bullish if both stocks can recover all their post-split losses & rally back above those ranges while bearish if the trapped longs that bought into all the hype of the splits & bought the highs continue to sell as they come close to breakeven. The psychological impact of those two stocks on the tech sector & broader market can not be underestimated IMO.