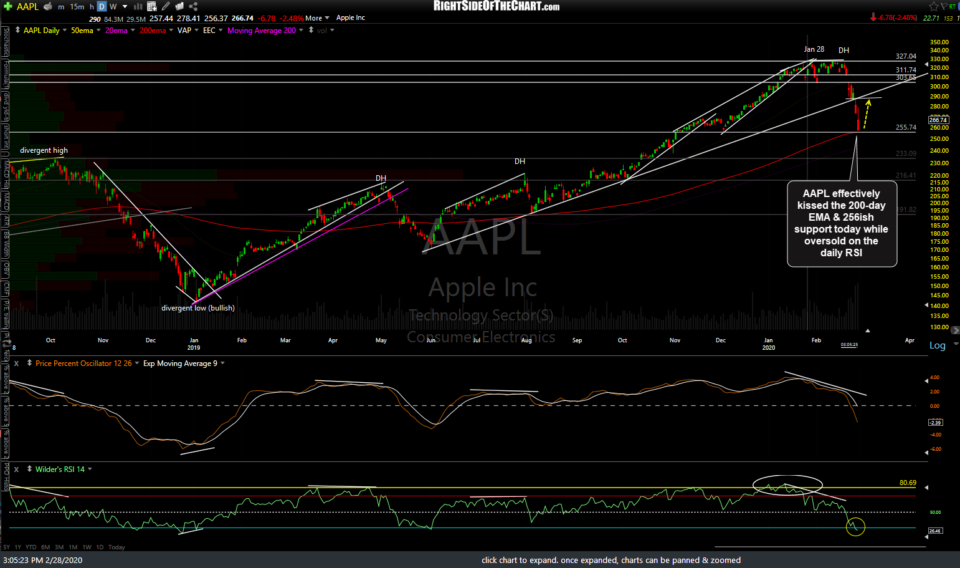

AAPL (Apple Inc.) effectively kissed the 200-day EMA & 256ish support today while oversold on the daily RSI, a potential reversal point for the first counter-trend, tradable bounce since the 21.80% plunge off their post-earnings high of 237.85 about one month ago. While we don’t have any decent evidence of a reversal or near-term bottom yet, I believe the case can be made for an objective (but aggressive) long entry here with stops set based on one’s expected bounce target(s).

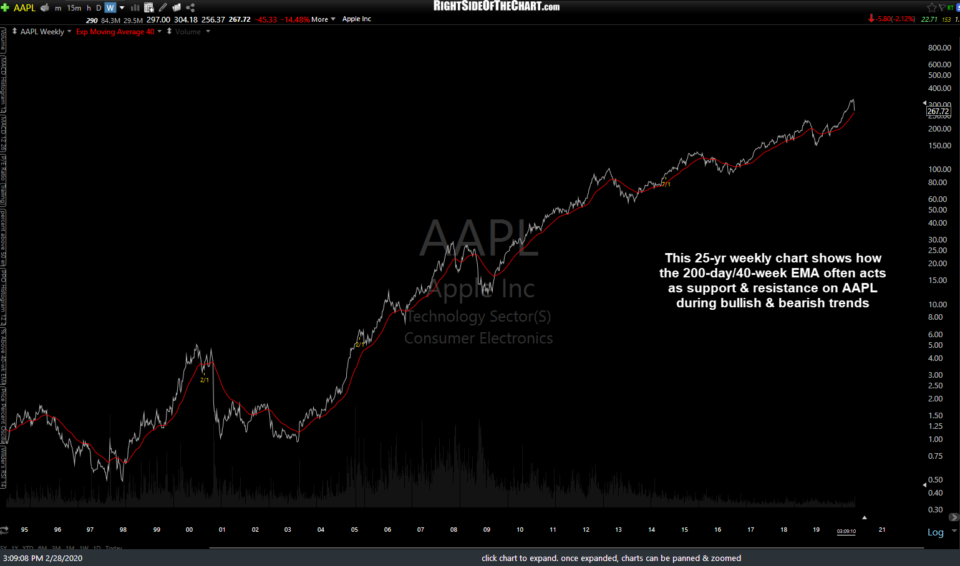

This 25-yr weekly chart below shows how the 200-day/40-week EMA often acts as support & resistance on AAPL during bullish & bearish trends (the 200-day EMA is the same as the 40-week EMA), although keep in mind that it is not uncommon to see the stock make a relatively slight & brief overshoot of the 200-day EMA during strong rallies or corrections before snapping back above or below it.

I’m only passing this along as a potential & aggressive unofficial trade idea as both AAPL & the stock market are still very solidly entrenched in a near-term downtrend coupled with the fact that a position on AAPL is essentially a proxy trade on QQQ (and vice-versa) due to the overweighting (QQQ was added as an official trade earlier today). Should AAPL bounce from at or near current levels, my initial & current preferred swing target would be the 286 level with the potential for a backtest of the trendline somewhat above that level.