Just to elaborate on my previous market comments, any bounce that may or may not materialize around the current support level on the Nasdaq 100 is expected to be a counter-trend rally in what I still believe to be the early stages of a much larger downtrend. Today the $NDX hit the first of four downside profit targets that have been listed on the $NDX live daily chart for some time now. My expectation at this time, which could change depending on how the charts play out going forward, is that before all is said & done, the $NDX will have fallen to my 4th & final (at this time) target which comes in around the 3150 level or the primary uptrend line on that chart, whichever comes first. That could take as long as several months or a short as several days, should the nearby support levels give way quickly.

With that being said, in order to most effectively utilize the trade ideas on RSOTC one must align the entries & exits of those trades with their own unique trading style and typical time frame. For example, very active, short-term traders like myself might opt to micro-manage a swing trade listing multiple price targets by booking profits as the earlier targets are hit (assuming the short-term charts confirm that a bounce is likely) while re-entering the position on the bounce with the intention of swinging the trade down to the final target(s). A less active, longer-term swing or trend trade might opt to ride out any short-term counter-trend bounces in the position with the intent of holding out for the 3rd or 4th target.

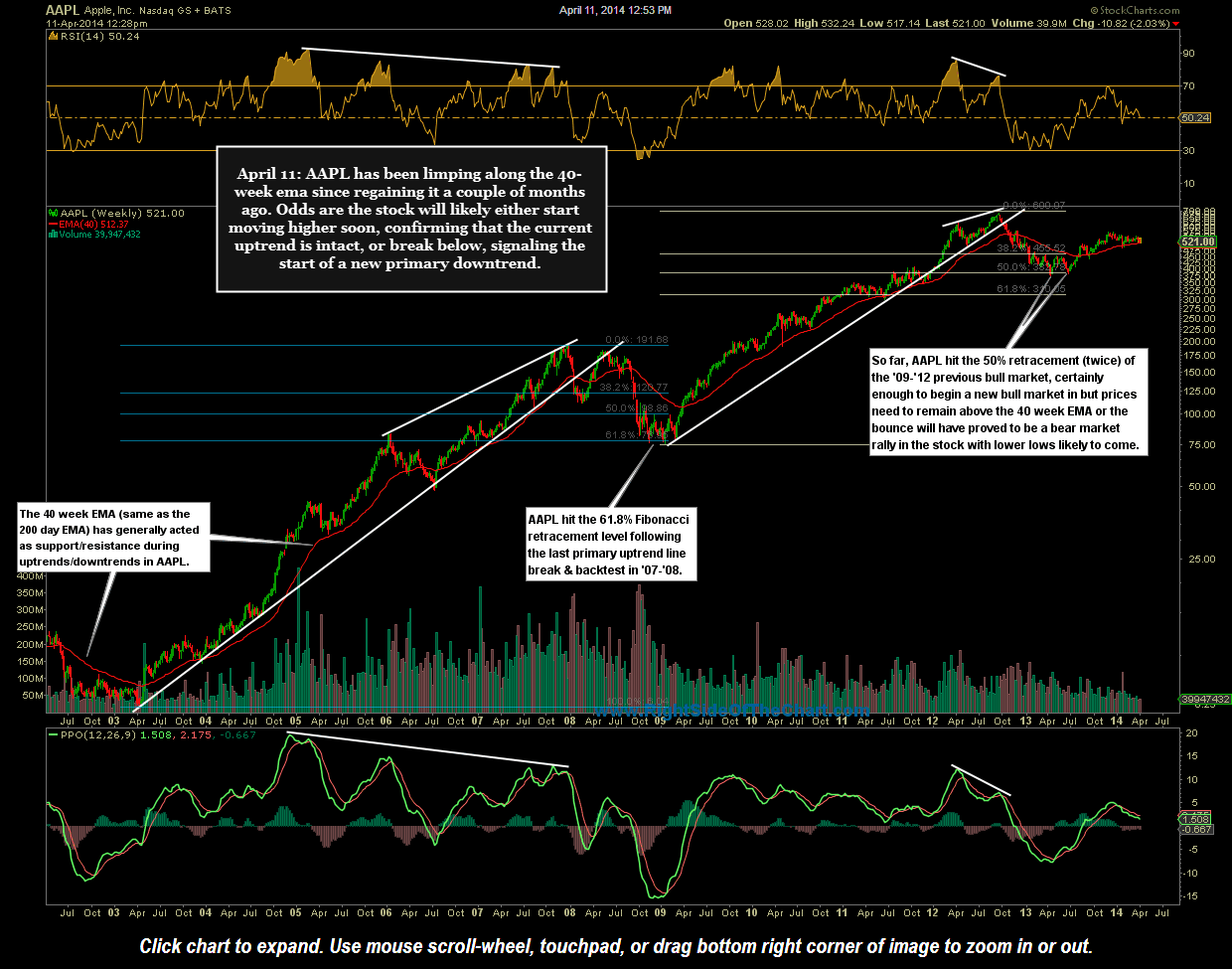

The bottom line is that trying to time all the minor swings in the market is not always easy and typically something best attempted by more seasoned traders. Those traders or investors that are longer-term bullish at this time should focus on initiating or adding to positions on pullbacks to support or breakouts of bullish chart patterns. For example, I’ve recently highlighted how well the 40-week EMA has defined major bull and bear trends in AAPL (Apple Inc.). After breaking down from the recently highlighted symmetrical triangle pattern on the daily chart, AAPL has now fallen to the 40-week EMA (which is the same as the 200 EMA on the daily chart), thereby offering an objective long entry, again for those who believe that the current correction has most likely run it’s course. Those with a longer-term bearish view could wait for a solid weekly close or two below the 40-week EMA in order to establish a swing short position on the stock.

Again, we may or may not get a tradable bounce in the $NDX from this current support level and as such, I plan to update some of the trade ideas that still offer an objective entry for those looking to add any long or short exposure at this time. As I might be updating a number of trade ideas today, email notification may not be sent out on each update so best to check the site throughout the day or over the weekend if looking for any trade ideas at this time. On a final note, for the most part, I try to avoid establishing any new positions on a Friday, especially towards the end of the day due to the extra overnight risk associated with weekends. Based on all the volatility lately, chances are that the market is going to gap one way or the other on Monday and that gap could be sizable.