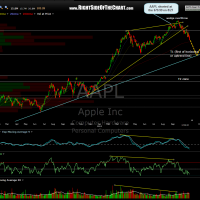

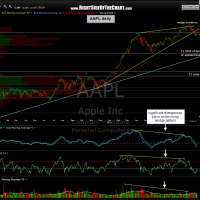

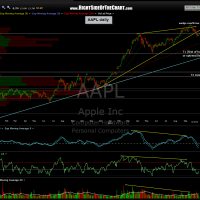

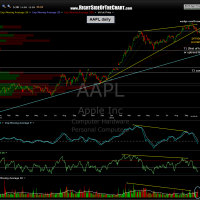

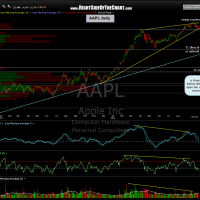

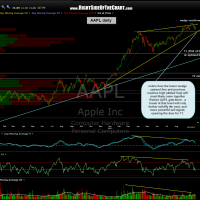

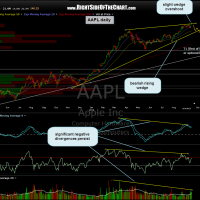

Here’s the updated daily chart (last) along with the previous string of daily charts on the Big Dog. I’d like to reiterate my bearish conviction on both AAPL and the broad markets. As you can see from this string of previously posted charts, this trade is playing out exactly as expected which only increases the chance that the scenario for both AAPL and the broad markets will continue as predicted for months now. At this point I favor T1, at least for a ‘tradeable’ bounce (one large enough in scope and duration to reverse the trade short to long once/if T1 is hit). I am constantly on the lookout for anything that might change my opinion on AAPL and the broad markets but the recent events (price action, technicals, complacency as measured by the VIX and other sentiment measures, bubble TV cheering the masses to buy the dip, etc..) tell me to continue to press the short-side aggressively.

Trading can be a very difficult game if one does not properly define their time horizon, develop a trading plan, and stick with that plan until/unless the evidence dictates otherwise. There will always be sharp, convincing counter-trend moves (rips and dips) during both uptrends and downtrends. However, stocks tend to drop during a downtrend or correction much faster than they rise during uptrends and the counter-trend bounces (bear market rallies) also tend to be very sharp & powerful. For those adept at trading the short-side, corrections and bear markets can be extremely lucrative, providing in just weeks or months, gains that might normally take months or even years to accumulate on the long-side during and uptrend or bull market. However, successfully navigating a correction or bear market can be difficult for many traders, particularly from a mental perspective.

For those swing trading the short side targeting the lower targets on most of the short trade ideas on this site, one must fight the urge to second guess their positioning every time the market pops & the media marches out bullish pundits advising to buy the dip. On the flip side, that doesn’t mean one can just load the boat short and disregard the use of proper stops and money management. The same basic rules that apply to trading and investing on the long-side are every bit important, if not more so, when swing trading the short side:

- Diversification: Not just diversifying amongst different individual positions (I usually prefer between 10-20 different positions) but also make sure that your are diversified amongst various sectors (tech, healthcare, retail stocks, etc..)

- Position Sizing: Beta-adjusting your position sizes is one of the most important aspects in trading IMO. You can click here to read more about that.

- Proper use of stops: Some traders use mental stops while some prefer hard stops. Less experienced or less disciplined traders should consider using hard stops but the important thing is to not let losses on ANY trade get out of control. Just one bad trade can wipe out weeks or months of hard earned gains from many successful trades. I can not over-emphasize the importance of loss mitigation in trading.

- Have a plan: First and foremost, you need to formulate your market bias (bullish or bearish) in order to be able to align your trades with the trend (or what you expect the trend to be going forward). There are times where I might be undecided on the direction of the market or believe that it will trade sideways. At those times, I either stop trading or use a short-term, hit-n-run trading style. If you are currently bearish, are you expecting a shallow correction or a more lasting top/trend reversal? If the latter, then you need to ignore the day to day “noise” and use wider stops on your trades while targeting the deeper target levels.

- Be flexible: Although having a plan is critical to trading, being flexible and adaptable is just as important. Always continue to study the charts, fundamentals and other data to either affirm that your plan is still appropriate or whether it might be time to adjust or change it. Remember, the markets are dynamic, not static. Bullish stocks and charts can & will turn bearish and vice versa. Always ask yourself, even when trading well: Has anything changed that might affect my take on the markets or my particular positions?