I’ve added new price target added at the 170.50ish support level (now T2 with the other previous targets re-sequenced) to the AAPL (Apple Inc) swing/trend short trade. With potential positive divergences building between price & the momentum indicators, should AAPL fall to T2 soon & reverse, it will likely put in a divergent low would could set the stage for a decent (tradable) counter-trend rally. Also, note the minor horizontal support line between the recent lows on the daily chart below as a solid break below that level would increase the odds off a another leg down towards the new second price target (170.50ish).

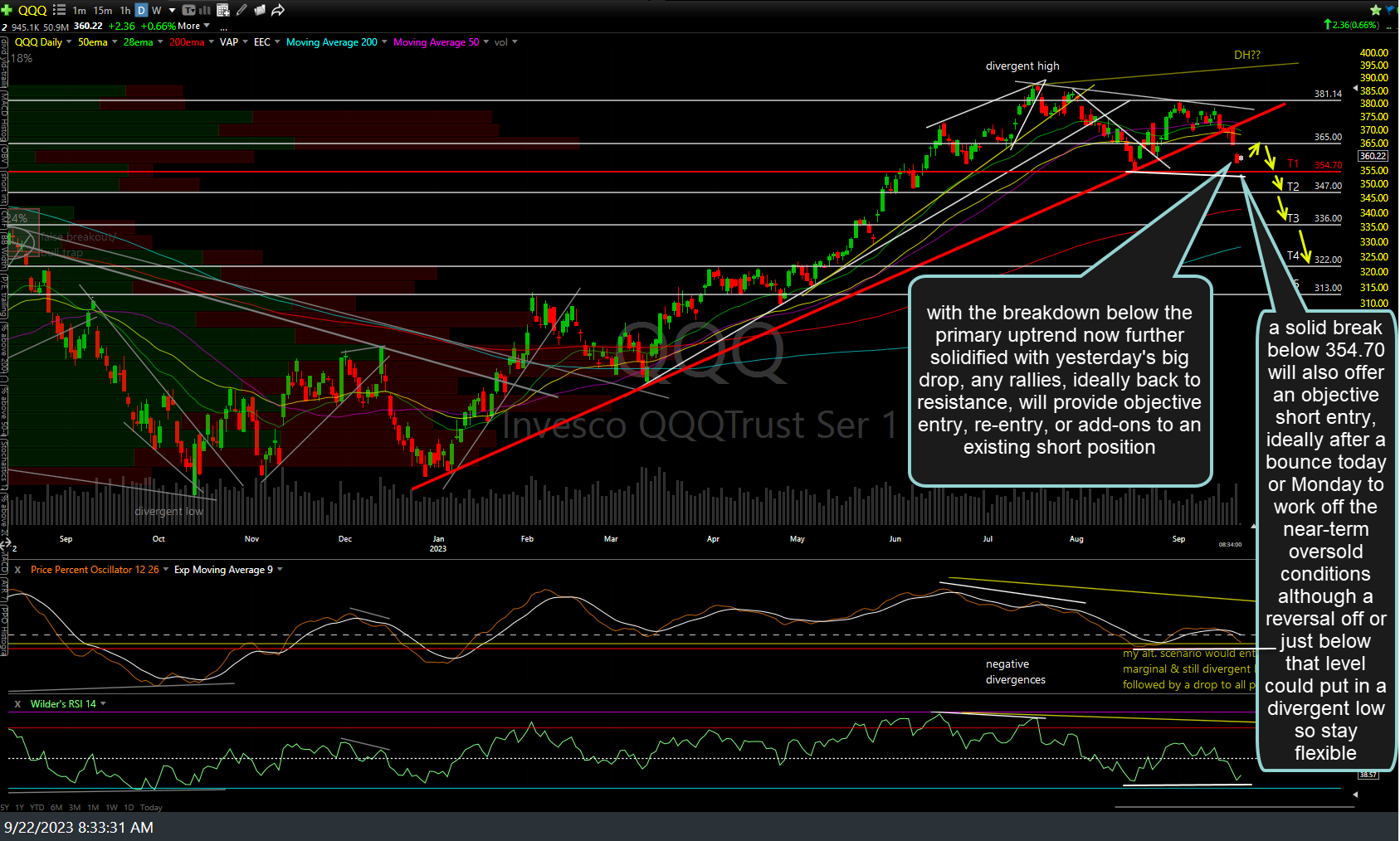

With the recent breakdown below the primary uptrend now further solidified with yesterday’s big drop, any rallies, ideally back to resistance, will provide objective entry, re-entry, or add-ons to an existing short position on QQQ (Nasdaq 100 ETF). While a solid break below 354.70 will also offer an objective short entry, ideally after a bounce today or Monday to work off the near-term oversold conditions although a reversal off or just below that level could put in a divergent low (similar to the AAPL scenario above) so stay flexible. I will communicate my thoughts if & as QQQ and AAPL approach those next price targets/support levels.