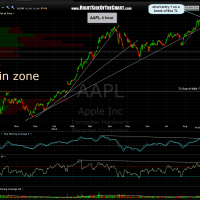

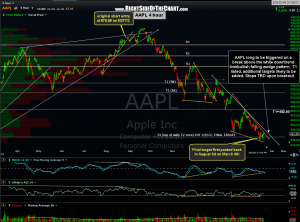

Now that AAPL has hit my original final downside target, added all the way back in August 2012 when the stock was within a few percentage points of it’s all-time high and still well within a powerful uptrend, I am now watching the stock for an entry on a long side trade. The reasons for this trade are 1) As mentioned, the stock has now fully fulfilled the expected downside move that I’ve been expecting for over 6 months now and that target was/is at very a very solid support level on the daily & weekly charts. 2) On both the daily & especially the weekly time frame, AAPL is at oversold levels which have historically signaled excellent buying opportunities. 3) As this updated 4 hour chart shows, AAPL has set up in a nice bullish falling wedge pattern which helps narrow down an objective entry point from a timing perspective (entry on a breakout above the wedge pattern). 4) If wrong, losses on the trade can be easily quantified with a stop not far below this key support level.

Now that AAPL has hit my original final downside target, added all the way back in August 2012 when the stock was within a few percentage points of it’s all-time high and still well within a powerful uptrend, I am now watching the stock for an entry on a long side trade. The reasons for this trade are 1) As mentioned, the stock has now fully fulfilled the expected downside move that I’ve been expecting for over 6 months now and that target was/is at very a very solid support level on the daily & weekly charts. 2) On both the daily & especially the weekly time frame, AAPL is at oversold levels which have historically signaled excellent buying opportunities. 3) As this updated 4 hour chart shows, AAPL has set up in a nice bullish falling wedge pattern which helps narrow down an objective entry point from a timing perspective (entry on a breakout above the wedge pattern). 4) If wrong, losses on the trade can be easily quantified with a stop not far below this key support level.

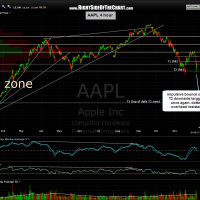

I’ve drawn two similar downtrend lines defining the top of the pattern (orange & white lines) but to help minimize the chances of jumping the gun, would prefer to wait until a break over the white downtrend line as the buy signal. The first target is 482.50 (set about 2.50 below the resistance level marked by that horizontal line to help assure a fill) with additional upside targets very likely to be added if the target begins to play out. As the actual entry price is unknown at this time, stops will be determined based upon entry. Although I only have an early, relatively shallow target listed at this time, I am also adding this setup to the Long-Term Trades category as AAPL may likely be offering an objective entry for longer-term traders and investors around current levels.

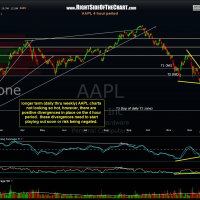

I recently posted a string of daily time frame charts illustrating the AAPL short off it’s all-time highs and here’s a string of the previous posted 4 hour charts that were posted along with that trade (note, the original entry on this first chart listed the short entry to be on a break of that minor uptrend line. However, the entry was revised just after that to be an active short at the open on Monday, Aug 27th, which was 679.99).