I don’t usually post this late but figured that I’d share a couple of charts with levels to watch as the stock futures started a fairly sharp drop shortly after the closing bell today in response to the Iranian missile strike on a US airbase in Iraq.

While one should take breakouts that occur on individual stocks in the after-hours or pre-market session with a grain of salt, it is worth noting that AAPL has made a solid & impulsive breakdown below the 60-minute price channel that has recently been highlighted. Should the breakdown stick into the regular session tomorrow it would likely result in additional selling in the broad markets tomorrow & later this week.

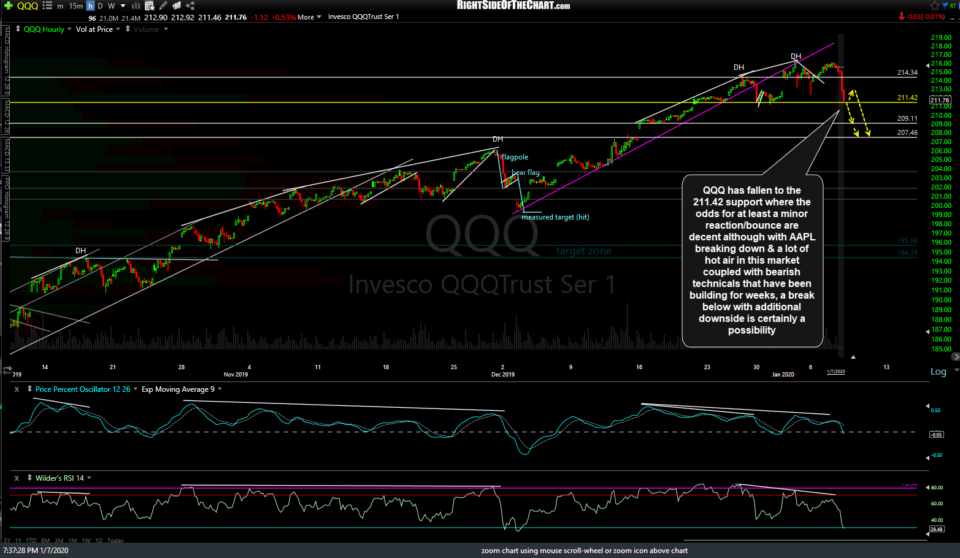

Currently, both /NQ & QQQ have fallen to & are trading right on the 8694 & 211.42 levels which are key near-term support levels highlighted in my recent analysis that would likely usher in additional selling if taken out with conviction (i.e.- a solid break below without a snapback recovery following a brief undercut of those levels). The odds for at least a minor reaction/bounce are decent here (even with a brief momo-overshoot first) although with AAPL breaking down & a lot of hot air in this market coupled with bearish technicals that have been building for weeks, a break below with additional downside is certainly a possibility. As such, active traders might opt to reverse an /NQ short to a long position here with a stop somewhat below in order to try and game a quick bounce while typical swing traders, including those short any of the index ETFs, might opt to ride out any minor zigs & zags as the case for a near-term correction is still decent.

- NQ 60m Jan 7th

- QQQ 60m Jan 7th AH