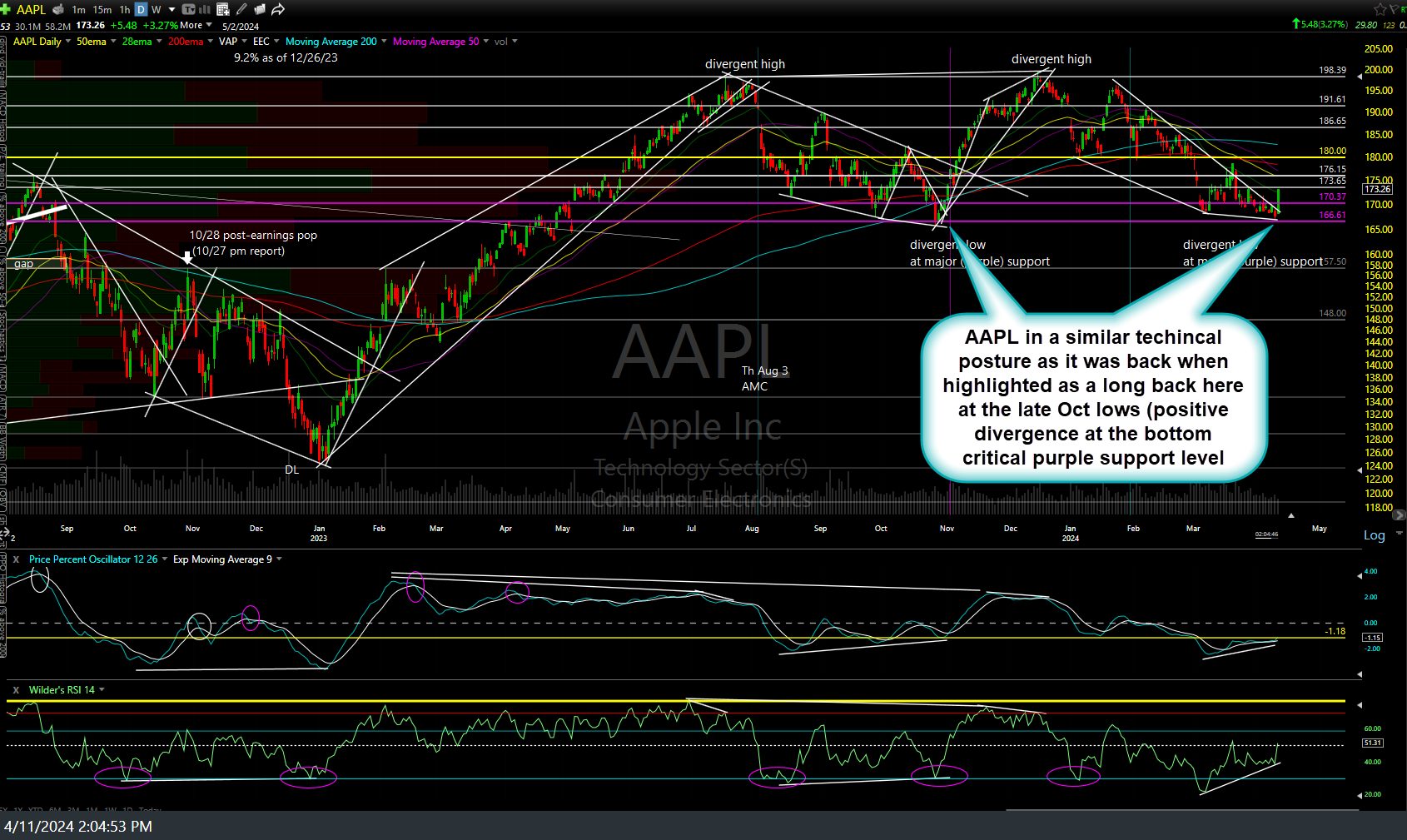

So I’m kicking myself for missing the obvious. I’ve been watching AAPL (Apple Inc) along with all the other FKA Mag 7 stocks very closely & even recently highlighted the stock back to the same level (key purple support around 167) it was at when I posted closing all shorts & going long both AAPL & the Q’s back in late Oct in this post, right at the end of the last big swing tradeable correction & start of one of the most powerful rallies in years.

AAPL bullish falling wedge breakout appears to be the cause for today’s rally although coming up on the first decent resistance (173.50ish) now as shown on the 60-minute chart below.

Shame on my for not checking on AAPL earlier today as the stock appears to be 100% (or close to it) the cause for today’s rally IMO. However, I will say that unlike back then, where I shared covering all swing shorts & going long, this time around it appears that this will most likely prove to be a bull trap/false breakout that will likely fail within the next week. Either way, the breakout (that I missed earlier) was glaringly obvious & I had even been covering the fact that AAPL was not only approaching that key support in recent videos but also expecting a bear market/counter-trend rally soon due to the combination of oversold conditions, stark under performance relative to the remaining FKA Mag 7’s, and positive divergences.

One of (and a very big) reasons that I believe any rally in AAPL will likely be relatively limited in both scope and/or duration is the fact the stock has only relatively recently broken below its primary multi-decade bull market uptrend line (off the 2003 lows) following a very big divergent high on the weekly chart & still appears to have a lot more downside in the coming months+. However, “relatively limited” is relative to the time frame (a multi-decade uptrend line spanning over 2 decades) so I can’t rule out the potential for a rally that could last several weeks or more.

Bottom line: Based on the longer-term bearish technical posture & outlook for AAPL, unlike late October, when it seemed a tradable rally was more likely than not, both the fundamentals AND technicals on both the major stock indices as well as the FKA Mag 7 stocks (collectively), top sectors of the $SPX, Treasuries bonds, etc.. are considerable different at this time and as such, I suspect this AAPL-induced breakout get sold into just as it starts to look & feel like the catalyst to take the indices to new highs. Video to follow soon & you can see some of the additional resistance levels on the AAPL 60-minute & daily charts above that are potential end-points for this post-breakout rally.