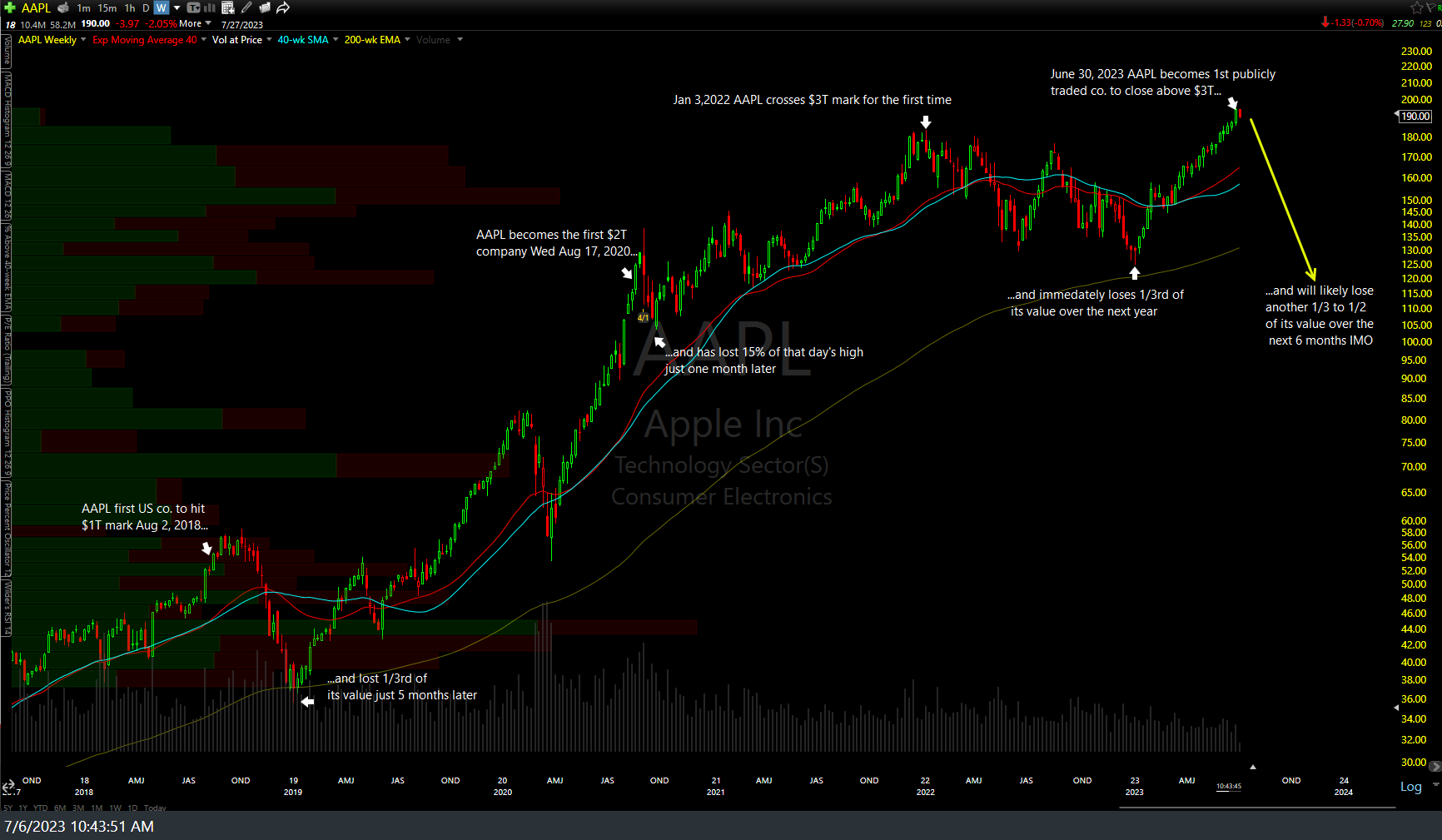

Upon returning from vacation back on July 6th, I posted what I believed to be a “kiss of death” for the world’s largest public traded company as well as the one of the most over-owned & over-loved stocks: AAPL (Apple Inc.). In that post I mentioned how the talking heads on TV were crowing over just how bullish it was for the stock to become the world’s first $3 trillion company, going on to lay out the case as to why I believed it was exactly the opposite; i.e.- more so a sign that a top was in or very near. (that post can be viewed here with the chart from that post below)

While the stock did indeed top shortly after that, falling as much as 14% so far from its June 30th $3T milestone close, it’s still only about a third of the way down to my call that the stock would likely lose at least a third of its value over the next 6 months. That means that if (and of course, a big IF) my call is going to pan out, as I still suspect it will, Apple needs to fall another 25% or by year end (just over 2 months). While I can’t say with certainty that will happen, I still expect that it will & if so, such a relatively large & swift drop in the largest component of the S&P 500 as well as the Nasdaq 100 would coincide with my recent expectations over the past week that the stock market is on the verge of a major drop.

You already know the key levels (red & purple supports on the QQQ & the Magnificent 7) that I’ve been highlighting recently, all of which both QQQ & the Mag 7 remain above… for now. However, if & when those levels go, as I suspect will happen very soon, that will substantially increase the odds of a major leg down in equities include the lead sled dog, AAPL (where the lead dog goes, the rest of the pack follows). Here’s the updated chart showing what the trajectory of Apple stock would have to look like for the call of a minimum 1/3rd haircut in market value of the most magnificent of the Magnificent 7 to pan out. Watching those key support levels closely.