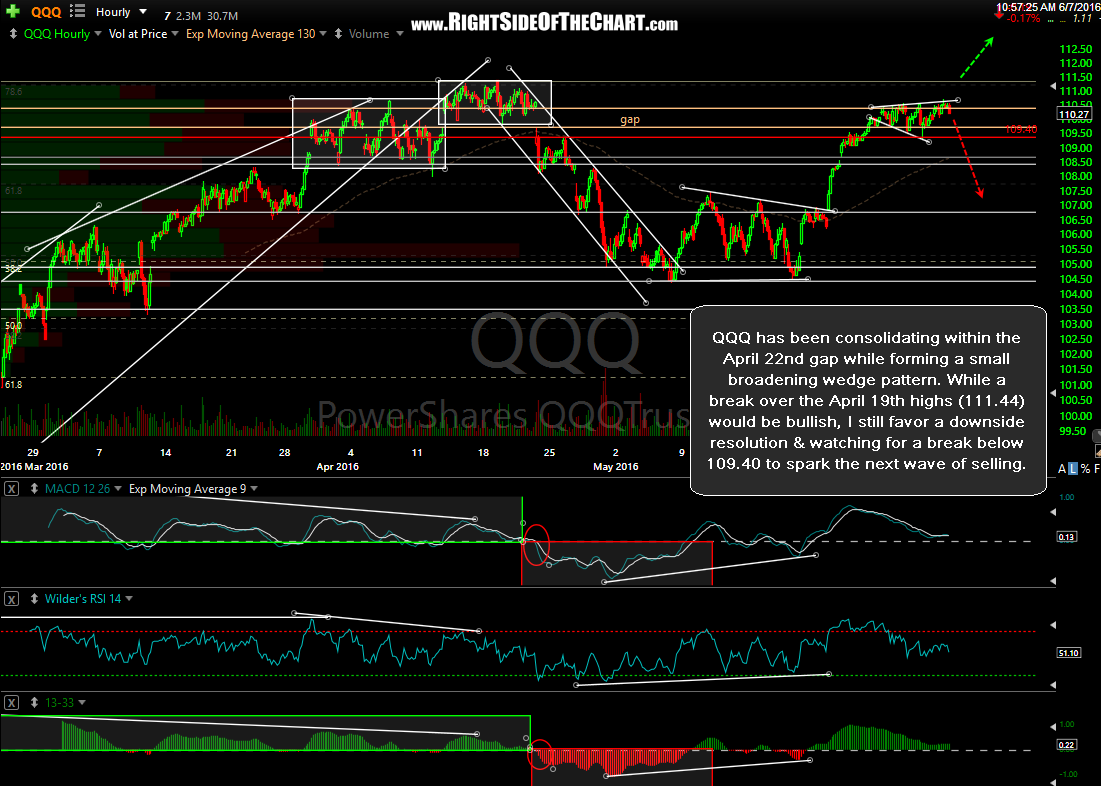

QQQ has been consolidating within the April 22nd gap while forming a small broadening wedge pattern. While a break over the April 19th highs (111.44) would be bullish, I still favor a downside resolution & watching for a break below 109.40 to spark the next wave of selling.

AAPL has formed a small flag/channel following the recent break below the larger ascending price channel on this 60-minute time frame. A break below this minor pattern would likely spur the next wave of selling. FB continues to hold above the key 116 support level… for now. A break below is likely to open the door to a move down to the 109 area, bringing QQQ down with it. AMZN continues to cling to this minor uptrend line while also just above the 723 support level (previous reaction high). A break below both is likely to bring AMZN, along with the market, down to any of all of the price targets shown on this 120-minute chart.

- AAPL 60-minute June 7th

- FB 120-minute June 7th

- AMZN 120-minute June 7th

So far, every squiggle has been called out in advance although this recent bounce is just a hair above where forecasted last week although GOOG should reverse here at the former support, now resistance level.

- GOOG 60 min June 1st close

- GOOG 60 minute June 2nd

- GOOG 60 minute June 3rd

- GOOG 60 2 min June 3rd

- GOOG 60 min June 7th