With the broad market still trading within the same 3% trading range for nearly the past month (i.e.- no new significant developments), I opted to spend some quality time with my immediate & extended family during vacation vs. posting updates as there wasn’t much to report. I do recall, however, while visiting one of my in-laws (one of those that always have CNBC on spewing out noise all day, every day the market is open) listening to all the incessant chatter from the bobble-heads on TV crowing about AAPL (Apple’s) milestone of being the first publicly traded company to close above the $3T market cap. So with that being about the “most significant” development in the stock market since I left for vacation on the 28th, I figured I’d share some stats.

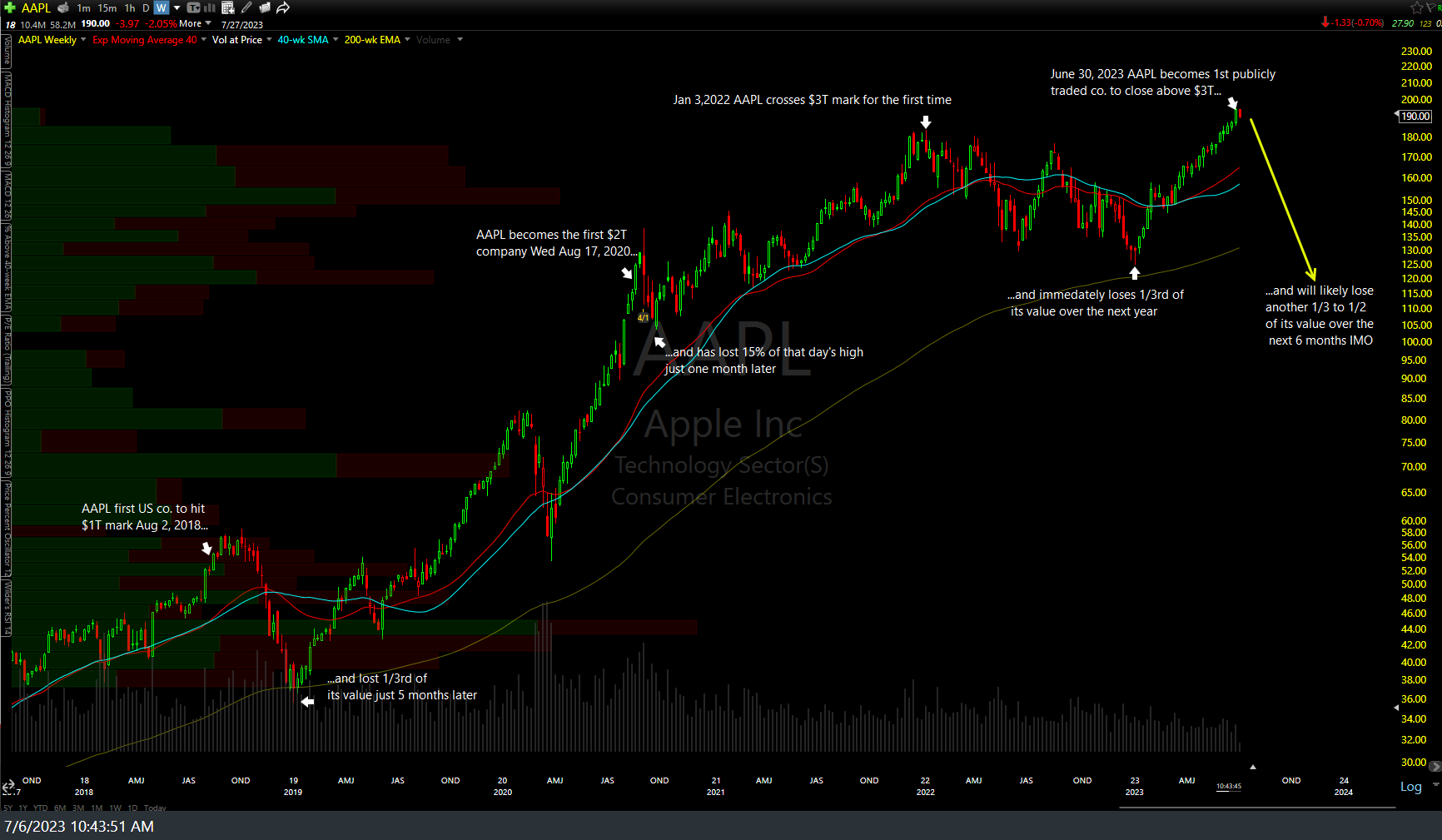

A quick Google-search of “AAPL crosses $X trillion market capitalization” (swapping X for 1, 2, & 3) shows that those seeming bullish headlines have been more of a kiss-of-death than a bullish sign for the stock. Apple was the first US company to hit the $1T mark on August 2nd, 2018. If you bought that “bullish” headline at the highs that day, just 5 months later you would have lost a third of your investment.

FF two year later & on Wednesday Aug 17, 2020 Apple became the first US publicly traded company to hit the $2T mark. Just one month later the stock was trading 15% lower.

The next big milestone came on Jan 3rd, 2022 when AAPL crossed (intraday) the $3T mark for the first time. That very day the stock peaked on that headline & once again, the stock lost 1/3rd (appx. $1T) of its value over the next year.

On Friday (June 30th), AAPL became the first publicly traded company to close above the $3T mark. Although I’m still waiting for a sell signal via a break of the primary uptrend line off the January lows to trigger a sell signal & objective short entry, by my analysis, Apple will likely lose another 1/3rd to 1/2 of its market value from its highs that day, assuming that some of the long-term trend indicators (more to come on that soon) flip back to bearish, confirming they were only brief whipsaws.