i was just asked what my stops or exit strategy for the index shorts would be. it was after the market close on friday aug 24th that i made this post adding both AAPL (officially) and the broad markets (unofficially) as shorts trade ideas at the market open on the following monday. although i did list my downside targets for the QQQ in this follow-up post this made on sept 24th, i realize that i had not listed any objective stops levels or exit strategy if the markets continued higher. therefore, i will take a look at the charts later today to determine some objective stops or scale-out strategies for those short. however, regardless of the bullish feel to the markets today, i typically prefer not to establish new trades or stop out of existing positions on the often violent swings that follow the fed announcements as the initial & even secondary reactions are often prone to reversals (therefore, leading to false breakouts and/or stop-loss triggers).

to reiterate, the reason for finally considering a short on the broad markets, after months of suggesting trading only individual stock patterns, was based largely on two criteria: 1) the technical posture of the weekly and daily index charts and 2) my technical read on AAPL. regardless of today’s bullish reaction to the fed meeting, nothing much has changed on either. currently the AAPL short is flat, basically at the suggested entry price (opening price on 8/27 of 679.99). the NDX/QQQ (my preferred index to short) is up a whopping 1% from the open price on the 27th and the SPX/SPY up 2.6%. my point is that although we could very well see some follow-thru to today’s move, those trades are far from triggering anything but a very tight stop.

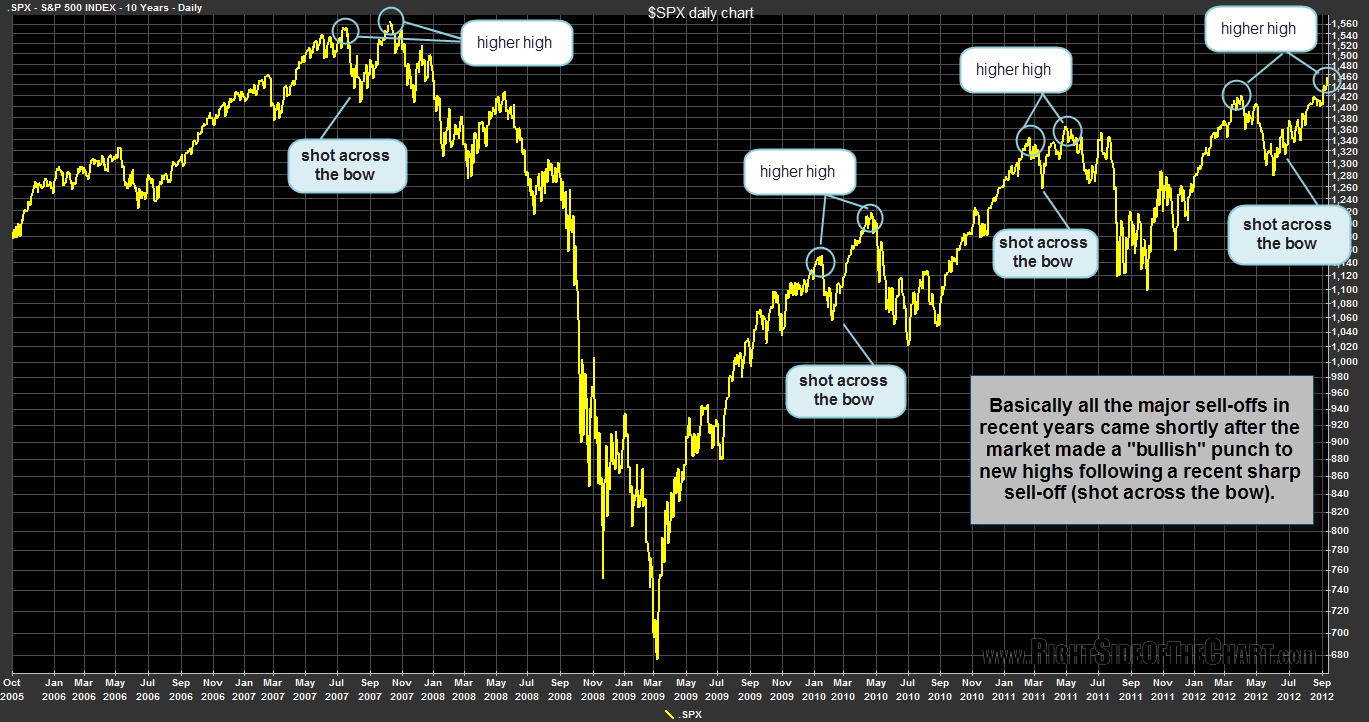

as far as technicals, i should clarify that although the weekly charts have not changed significantly in the last few weeks, we have seen a few bullish technical events that have dampened my longer-term bearish bias. first would be the $USD (& $EUR/US breakouts of those key uptrend (downtrend) lines posted recently. Secondly, we have both TLT & $TYX breaking below/above those uptrend/downtrend lines posted yesterday, although we still need to see a solid close above/below those lines before an official breakout. The fact that some of the indexes are breaking to new highs on a daily time frame is not as concerning to me yet as most key market reversals immediately follow a break to new highs when those highs follow a previously sharp correction, as the chart below illustrates.