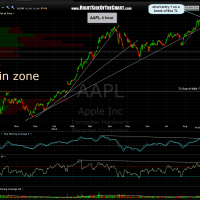

as i missed getting this out before the close today, i will be adding AAPL as a short on the open monday. for tracking purposes, i am using this daily chart for entry (monday’s open) and targets. however, i have also added some different entries and targets on this 4 hour chart for more active traders. my preferred target on this trade over time is the top of the 2nd target zone (T2), although i would expect a reaction off T1 if this trade plays out.

being that i think the R/R now (finally) favors being short AAPL, i now believe that it also a good time to finally start shorting the broad markets (via etfs, futures, options, or whatever your preferred vehicle). for months now, i have been stating my strong preference of shorting individual stocks vs. the broad market. even as the market went on to recently make multi-year highs there have been many profitable, even some very profitable short trades that have hit one or more price targets over the last few months. in addition to identifying the some of the more attractive technical patterns, the most likely reason for the success on many of these trades also meshes with the reasoning behind my preference to trade the best individual stock patterns vs. the broad market, particularly on the short side:

in the final stages of a bull market we typically see a deterioration in market breadth as fewer and fewer mega-cap stocks (which carry the heaviest weightings in the primary indices) lift the market higher. while the debate of whether or not we are in fact at or near a market top will only be proven in time, one can not argue that market breadth has deteriorated considerable as the market has moved higher since the early june lows. hence, it is not rocket science or wizardry that many of the short trades ideas over the last few months have been very profitable. it is the simple fact that if you have the leading index, the $NDX, with a nearly 20% weighting in AAPL, which is up 24.2% since it’s peak low on may 21st while the $NDX is up 12.1% (yes, exactly half) over the same time period, that the other 80% of stocks must not be doing so hot.

keeping on that train of thought, remember that the next top 10 or so holdings in the NDX, although not nearly as large as AAPL, dwarf the majority of the stocks in the index (btw- AAPL is also the second largest weighted component in the S&P 500 as well). therefore, although AAPL did the bulk of the heavy lifting, the markets were also dragged higher by other over-weighted components such as GOOG, ORCL, and AMZN. i don’t have the time or resources to strip out these names and crunch the numbers (although I have illustrated this point recently comparing these indexes to their equal-weighted counterparts), but i am willing to bet if you compared the top performing 50% to the bottom performing 50% of stocks in these indices that you’d see why it’s not so hard to debunk the old wall street sayings such as “the trend is your friend” or “all ships are lifted in a rising tide” and why shorting the most attractive (or should i say unattractive, i.e.- bearish) patterns in an uptrend has been an overall profitable strategy, especially when coupled with trading the most attractive long-side patterns as well (a long-short portfolio). conversely, one would most likely have a very tough time shorting even the weakest stocks during a strong uptrend that is accompanied by strong market breadth (broad stock participation).

the “your trend is your friend” statement has held true for generic shorting of the broad market (shorting the SPY, buying short index etf’s, etc..) and has proved to be the best advice for general investors who only passively manage their portfolios using broad market mutual funds or tracking etfs. however, i now believe that the numerous signs of non-confirmation on the rally off the june 4th lows, in conjunction with the technical posture of both the broad markets as well AAPL, the single largest company (by market cap) in the world as well as the heaviest weighting in the key broad market indices (S&P 500, Nasdaq 100), provides an attractive risk/reward profile for shorting the broad markets. there are nearly countless trading vehicles and several strategies to do this but scaling into etfs (shorting the SPY, QQQ, etc.. or buying SH, SDS, QID, etc… in gradually lots over the next few weeks) is a simple and effective strategy.

i will also spend some time over the weekend trying to identify some of the most attractive sector etfs. (assuming Ivan doesn’t hit, as currently i’m in the expected path and might have to spend the weekend battening down the hatches and/or evacuating). until then, here’s the daily & 4 hour charts of AAPL. stops on an AAPL short would depend on one’s own trading style, risk tolerance and preferred target. the final swing target, T2, is about 35% below current levels so a ~10% stop from entry would make sense (providing 3.5:1 R/R), while shorter-term “less bearsih” traders expecting a pullback in AAPL but an extended continuation of the bull market might prefer on of the shallower targets and a tighter stop.

finally, this should go without saying but to just to be clear: never take a trade that does not fit your own risk tolerance, comfort and experience level. shorting stocks or even diversified etf’s is certainly not for everyone, especially those new to trading or investing. whether long or short (or both), never put all of your eggs in one basket and always know exactly why you are buying (or selling) a position; what is your price target(s), where will you exit if the trade goes against you. don’t just count the money that you will make on the trade if correct, but also how much you will lose if wrong. also be careful of adding to or averaging down on a losing position. many experienced traders will only add to a winning position, never adding to losing trades. one exception i will make to this rule is when i decide to scale into a position. right now i am mostly short but if i were in cash or all longs right now, i might add, for example, 20% of my portfolio short over the next 5 weeks or maybe 10% per week for 5 weeks if i only planned to be 50% short.