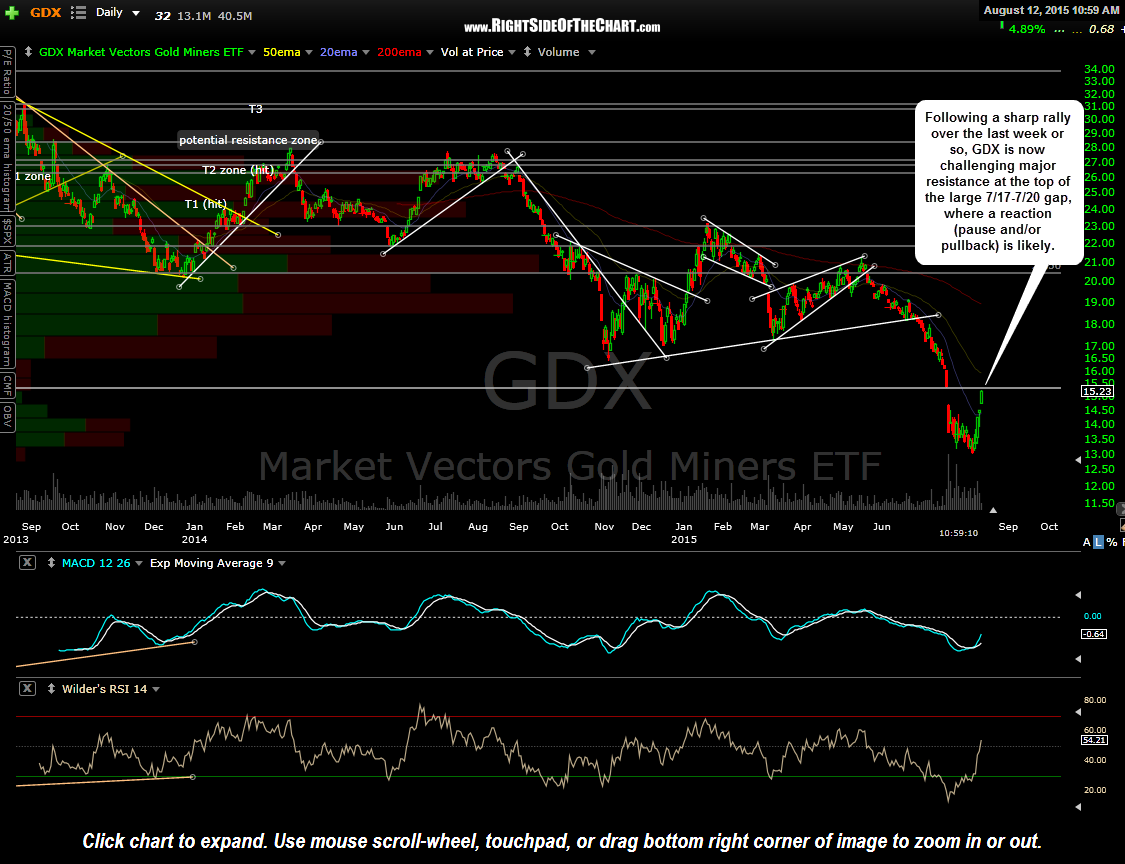

Following a sharp rally over the last week or so, GDX is now challenging major resistance at the top of the large 7/17-7/20 gap, where a reaction (pause and/or pullback) is likely. Although the current momentum could quite possibly allow the miners to make a solid break back above the top of that gap, it might be prudent to set a tight trailing stop if long the miners.

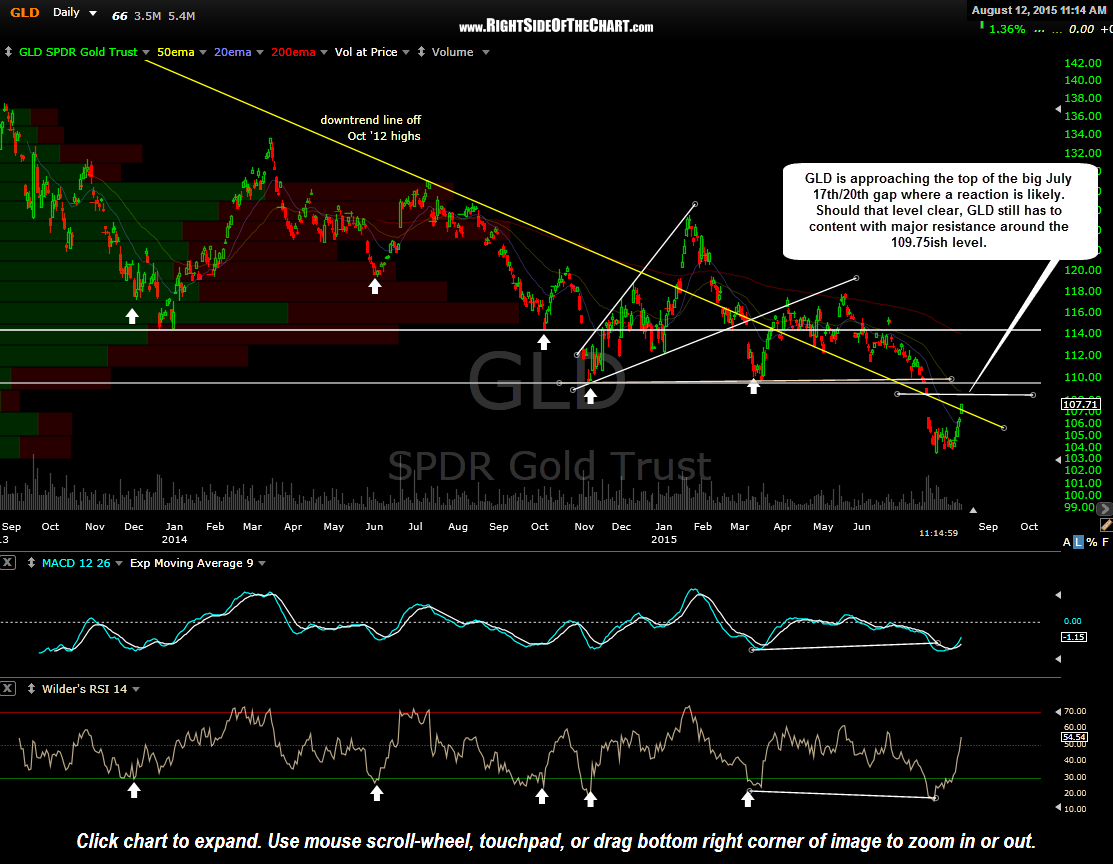

GLD is also approaching the top of its comparable July 17th/20th gap which comes in at 108.40, 73 cents above where GLD is currently trading as I type. As with the miners, I would expect at least an initial reaction in this intial backfill of that large & very technically significant gap. Should GLD manage to take out that gap resistance, it still has major resistance not far above around the 109.75ish level to contend with.

On a positive (bullish) note, SLV has managed to regain the recently highlighted 14.70 key resistance level although a solid close above that level & especially a few more days trading back above would help to strengthen the bullish case, especially with all the recent whipsaw signals lately.