IWM (Russell 2000 Index Tracking ETF) is currently trading below the bearish rising wedge pattern on the daily time-frame. As always, additional confirmation of this sell signal will come on a solid close (end-of-day) below the pattern as this is a daily-time frame. A link to the live, annotated chart of $RUT is available on the Live Chart Links widget on the right-side of the home page.

Officially, the recent TWM trade was stopped out as it pierced below the suggested stop of 34.50 on April 15th although I still believe that an IWM short (or TWM long for a relatively quick trade) still looks promising, especially now as a nice bearish engulfing candlestick is in the works so far today. For those considering shorting or adding to any broad index etf short position, keep in mind that AAPL will be reporting earnings after the market close today which is almost certain to cause the markets to gap one way or the other tomorrow morning. Despite the initial reaction from Apple’s earnings announcement & conference call, I continue to believe that the risk/reward for the broad markets remains skewed to the downside (i.e.- the next 10% move from here is more likely to be a 10% drop before a 10% gain).

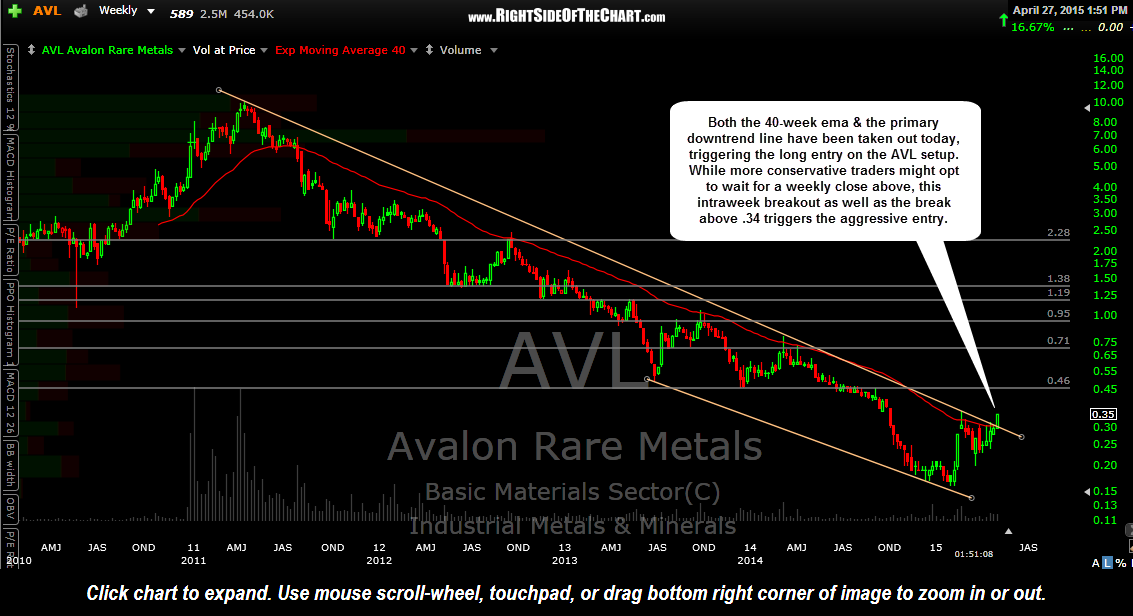

Precious metals & select commodities or commodity related stocks, such as the SGG, REMX, EC & *AVL still look promising as long-side hedges to a portfolio with short exposure to the US equity markets as well as “pure-play” longs, for those who are not comfortable with shorting stocks. *(AVL has broken above the weekly downtrend line today, shortly after clearing the 40-week ema, click here for notes on the AVL Long Trade Idea).

Both the 40-week ema & the primary downtrend line on AVL (Avalon Rare Metals) have been taken out today, triggering the more aggressive long entry on the AVL setup. While more conservative traders might opt to wait for a weekly close above, this intraweek breakout as well as the break above .34 has triggered the aggressive entry.