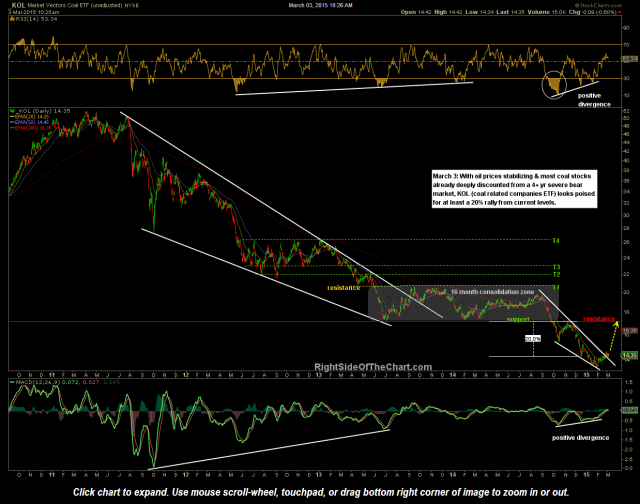

With oil prices stabilizing & most coal stocks already deeply discounted from a 4+ yr severe bear market, KOL (Market Vectors Coal ETF), which holds companies with various types of exposure to the coal sector such as producers, railroads, etc.., looks poised for at least a 20% rally from current levels.

My expectation is for a move up to the 17.00 area (first target), which is likely to act as major resistance as that was the base of 16 month consolidation zone from late May 2013 through late Sept 2014. If & when KOL clearly takes out that level, the odds will be good that the vicious bear market in the coal sector, which kicked off in mid-2011, will most likely have ended. As such, KOL has the potential to morph into a much longer trend trade/investment with additional price targets to be added.

Until the 17.25 area (the actual resistance with the target set 0.25 below) is clearly taken out, the choppy price action in most energy related stocks (oil, coal, solar, etc..) that we have seen lately is likely to continue. As such, longer-term traders & investors interested in taking a position in KOL might consider a scale-in strategy by accumulating fractional positions of KOL over the next several weeks/months. The suggested stop for KOL for a position initiated around current levels would be on a weekly close below the recent low of 13.45.