SLV (Silver ETF) has impulsively & convincing taken out both the downtrend & 16.05 horizontal resistance level, thereby greatly increasing the odds that the near-term upside price targets (T1 & T2) will be reached. Consider a stop below 15.65 or higher depending on your preferred price target(s).

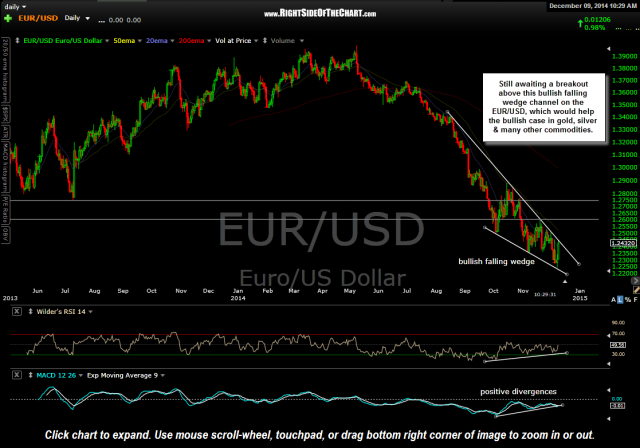

I also continue to closely monitor the US Dollar, Euro, & Yen for the expected trend reversals, including a breakout of this bullish falling wedge pattern in the EUR/USD currency pair. Should these major currencies reverse trend, even if they just experience a healthy counter-trend correction that might only last a week or so, that would almost certainly add to the near-term & possibly longer-term bullish case for gold, silver & mining stocks.