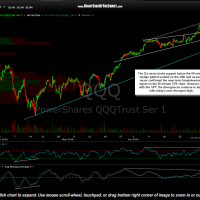

Just over a week ago, on June 24th, I posted the breakdown of a bearish rising wedge pattern on the SPY 60 minute chart & along with a potential wedge formation on the QQQ. Although not added as an official trade idea, I did mention that a short entry on the SPY with a stop above that day’s high (196.50) could offer an objective entry for an aggressive trade. The 196.50 level was exceeded today which would have triggered the stop for the aggressive SPY short. I had also mentioned that despite the bearish implications of the SPY breakdown today, we need to see the Q’s follow suit before we have a decent short to intermediate-term sell signal in the US equity markets. The Q’s never did break below their respective uptrend line & in fact, found support exactly on the bottom of the pattern (support) later that same day as well as the following morning and have not looked back since.

- SPY 60 minute July 1st

- QQQ 60 minute July 1st

All-in-all, nothing but bullish price action in the US equity markets since that 60 minute SPY breakdown on the 24th. Currently I don’t see any reason to be short the US markets although I would be very selective on establishing new long positions at this time. As this updated 60 minute chart of the SPY shows, prices are now backtesting the same uptrend line shown on that previous chart (extended on this most recent iteration). Both the SPY & the QQQ also continue to build bearish divergences with their new divergent highs today, although I will say that those divergences will likely be negated soon, should prices continue much higher over the next day or so.

In summary, I’m continuing to keep things light while focusing on the most attractive setups. Also keep in mind that this abbreviated trading week is typically a low-volume trading week and the impressive gains in the US equity indices today are being made on below average volume (a sign of non-confirmation). Those long the broad markets (SPY, QQQ, MDY, etc..) might want to continue to tighten up stops to protect gains while those looking to short the next pullback might consider waiting for some decent sell signals on at least the 15 minute time frame & preferably the 60 minute frame.