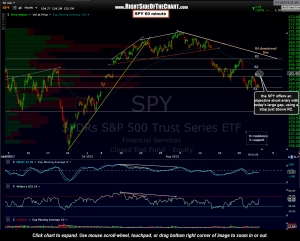

With the $SPX/SPY solidly intrenched in a short-term downtrend and the previously discussed 20/50 ema death cross just one red close away, the SPY may offer an objective short entry for aggressive traders looking to add some short exposure and/or chance to reduce some long exposure.

With the $SPX/SPY solidly intrenched in a short-term downtrend and the previously discussed 20/50 ema death cross just one red close away, the SPY may offer an objective short entry for aggressive traders looking to add some short exposure and/or chance to reduce some long exposure.

The SPY has gapped about 1/2 way between R1(1st resistance) & R2. Gaps are often filled once prices enter from above or below and as such, a push to up to the R2 level before prices reverse is possible. However, considering the current near-term trend is still lower, the SPY (or any $SPX proxy trading vehicle, such as the ES minis, SDS, etc..) may offer an objective short entry here with a relatively tight stop above the R2 level.

My preferred scenario would have prices turning lower immediately or shortly after the open today although a move up to the R2 level (165.89) today or tomorrow is not out of the question. If, by chance, the R2 level is clearly taken out, a move up to R3 would then be likely. Anything move above that the R4 level (orange downtrend line) would quickly begin to chip away at the bearish scenario & open the door to new highs. However, if today’s gap is faded and especially if the SPY manages to print a red close, not only will that be a psychological blow to the bulls but it would also trigger the aforementioned 20/50 death cross on the daily $SPX, indicating that a new intermediate-term downtrend is most likely underway.